“Never let the future disturb you.

You will meet it, if you have to, with the same weapons of reason

which today arm you against the present.”

─ Marcus Aurelius, “Meditations”

Making predictions is always tricky, and short-term forecasts are seemingly more difficult than long-term forecasts because timing plays such an important role. That said, predictions can be fascinating and informative, even if some if not many of them turn out not to occur. We share our list of predictions below that we believe will likely influence the economy and the capital markets in 2022.

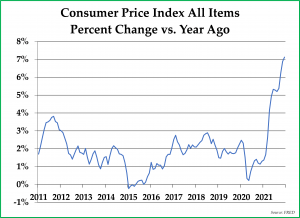

- The Consumer Price Index decelerates during the first half of the year. During the first six months of 2022, the inflation rate decelerates

slightly as the dollar strengthens and many commodity prices (temporarily) weaken. We make this prediction for two reasons. First, without any new stimulus bills, the level of Federal government spending is set to decline by $1.3 trillion vs. last year, with a large part of the year-over-year decline occurring during the second quarter. That projected drop in Federal spending represents approximately 6% of U.S. GDP. Second, even though Federal spending is forecasted to decline this year, the Federal Reserve has become increasingly concerned about inflation and is starting to tighten monetary policy. Just as fiscal stimulus and monetary stimulus combined are likely to create inflationary pressures, the combination of fiscal tightening and monetary tightening is likely to reduce inflationary pressures.

slightly as the dollar strengthens and many commodity prices (temporarily) weaken. We make this prediction for two reasons. First, without any new stimulus bills, the level of Federal government spending is set to decline by $1.3 trillion vs. last year, with a large part of the year-over-year decline occurring during the second quarter. That projected drop in Federal spending represents approximately 6% of U.S. GDP. Second, even though Federal spending is forecasted to decline this year, the Federal Reserve has become increasingly concerned about inflation and is starting to tighten monetary policy. Just as fiscal stimulus and monetary stimulus combined are likely to create inflationary pressures, the combination of fiscal tightening and monetary tightening is likely to reduce inflationary pressures.

- The stock market corrects during the second quarter. Along with commodity prices, stock prices become pressured in Q2 in response to the combination of fiscal and monetary tightening described above. Congress reacts to the correction by passing a new multi-trillion dollar bipartisan fiscal stimulus bill to protect their mid-term election prospects. The bill contains several of the Build Back Better bill’s provisions and enough pork to persuade a few Republicans to support the bill. At the same time, the Federal Reserve announces that it will immediately begin buying U.S. Treasuries at an accelerated rate to stimulate the economy and finance all of the new government spending. The stock market recovers quickly in response to these new fiscal and monetary stimuli.

- Gold and gold miners regain their shine. After a lackluster 2021, the price of gold increases to above $2,000/ounce in anticipation of and, subsequently, in response to a depreciating dollar and lower interest rates resulting from these new fiscal and monetary stimulus measures. Gold miners begin to outperform as an asset class as Mr. Market starts to recognize their attractive valuations and increased level of free cash flow generation. Reversing decades of anti-gold rhetoric, Warren Buffett decides to buy gold for the first time, purchasing over $10 billion of physical gold with Berkshire Hathaway’s cash.

- The U.S. stock market underperforms the rest of the world’s stock markets. Towards the end of the year, as Treasury bond yields decline while expected Federal deficits increase, the Euro, Yen, and most emerging market currencies rise in value vs. the U.S. dollar. The U.S. stock market, while generating a positive return in 2022, underperforms other developed and emerging markets for the first time in several years. Notably, the U.S. stock market also underperforms gold in 2022.

- Energy prices continue to rise. Political, capital market, and geological constraints continue to limit capital investment commitments to energy exploration. The price of oil exceeds $100/barrel. Traditional energy stocks and alternative energy stocks appreciate more than 20% in 2022 due to an increasing expectation of non-transitory, elevated energy prices. The Biden administration threatens to place price controls and export controls on oil and natural gas to limit “price manipulation” as mid-term elections loom. The sale of electric vehicles and hybrid vehicles boom as drivers seek to defray their rising gasoline bills.

- Congress finally legalizes cannabis at the Federal level. The new bipartisan law removes cannabis from the Controlled Substances Act and expunges cannabis-related criminal convictions. The new law also makes it easier for U.S. entrepreneurs to start cannabis companies and for U.S. institutional investors to commit capital to existing cannabis companies. Banks trip over themselves as they try to establish banking relationships with the previously unbanked cannabis industry. Cannabis-related stocks in the United States more than double when the law is signed as a deluge of institutional capital flows into the sector.

- AMC and other meme stocks continue their fall from bubble levels, while value outperforms growth, as is often the case during inflationary environments. AMC’s share price declines by more than 90% from peak to trough. Other meme stocks, such as Gamestop, experience a similar share price deflation. Many Reddit investors find themselves financially ruined by failing to diversify appropriately and by believing that investment fundamentals matter in the long-term less than hype and greater fool investment theories. Several Congressmen call for hearings to determine which companies are responsible for so many people losing so much money in these meme stocks.

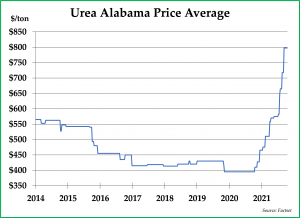

- Food prices surge during 2022. Due to extremely high fertilizer prices (see graph below of the price of urea), farmers worldwide decide not to

plant crops on their marginal acreage in 2022, resulting in a shortfall of new grain supply at a time where inventories are already low. Rising food prices engender increasing social and political instability. The political instability begins in already-unstable Kazakhstan but spreads across many developing countries where food and energy-related expenditures represent a large proportion of household budgets. Governments respond to rising food prices with proposals for increasing food subsidies, which is helpful for short-term political prospects but terrible for containing rising food prices over the long term.

plant crops on their marginal acreage in 2022, resulting in a shortfall of new grain supply at a time where inventories are already low. Rising food prices engender increasing social and political instability. The political instability begins in already-unstable Kazakhstan but spreads across many developing countries where food and energy-related expenditures represent a large proportion of household budgets. Governments respond to rising food prices with proposals for increasing food subsidies, which is helpful for short-term political prospects but terrible for containing rising food prices over the long term.

- Cryptocurrency and blockchain investments and applications continue to grow. The sector becomes more ingrained in the global economy and markets, against the wishes of policymakers at the U.S. Treasury, the Securities & Exchange Commission, the Federal Reserve, and the Internal Revenue Service. The SEC goes another year without approving an ETF that could buy and hold bitcoins while central banks accelerate their efforts to launch their own digital currencies. Institutional investors continue to test the waters with cryptocurrencies, slowly committing incremental capital to interesting projects. The price of bitcoin declines by more than 50% at some point in the year and also doubles at another point in the year. Bitcoin exits the year with a price above $50,000.

- Republicans win back control of the Senate and Congress on campaign promises to tame inflation by reducing government spending. Republicans’ campaign promises are kept for less than 60 days until the stock market corrects again. Congress quickly puts together another aggressive fiscal stimulus bill to support the economy and the stock market. Alas, that is a story that we will have to wait until 2023 to explore further.

Putting together these ten predictions was an interesting and thought-provoking exercise. It’s important to note that we humbly assume many of them will turn out to be incorrect. We generally place very little weight on our ability to predict short-term events, just as we place very little weight on others’ ability to predict short-term events. With that said, we very much do have our eye on long-term fundamental trends. We are also constantly looking for situations where the market is undervaluing a company or financial asset.

For example, many investors, including ourselves, correctly predicted the housing bust that eventually caused the Great Financial Crisis in 2008. We sent a letter to our clients in 2005, advising them not to chase the housing bubble; we knew that the housing market was in a bubble which, sooner or later, would turn into a painful bust. While we knew that pain was coming to the financial markets when the housing bubble turned into a bust, we had no idea it would not happen until September 2008. During those years, our key investment insight was that we wanted minimal housing exposure because housing and the debts associated with housing seemed to be a ticking time bomb. While our timing was a little early, our top-down view of the housing bubble kept us out of a fair amount of trouble.

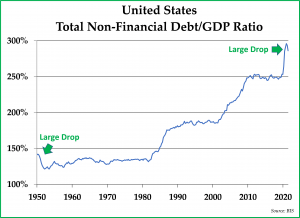

At the present moment, global debt as a percentage of GDP is at a higher level than it has ever been in recorded history, going back for 5,000 years. Like the housing bubble, a rising global debt level also represents significant investment risk. We expect that the resolution to this problem will occur more slowly than the housing bust, taking the form of a multi-year inflationary period. That inflation will likely be accompanied by continued efforts by the Federal Reserve to cap interest rates at low levels and periodic multi-trillion-dollar stimulus packages passed by Congress. If our policy forecast is correct, GDP should increase faster than debts over time. Indeed, as you can see in the chart to the right, the combination of high inflation and low-interest rates has worked as an effective policy in slightly reducing the U.S. Debt/GDP ratio over the past twelve months. Notably, even with the recent drop, the Debt/GDP ratio is still quite far from normal.

Like the housing bubble, a rising global debt level also represents significant investment risk. We expect that the resolution to this problem will occur more slowly than the housing bust, taking the form of a multi-year inflationary period. That inflation will likely be accompanied by continued efforts by the Federal Reserve to cap interest rates at low levels and periodic multi-trillion-dollar stimulus packages passed by Congress. If our policy forecast is correct, GDP should increase faster than debts over time. Indeed, as you can see in the chart to the right, the combination of high inflation and low-interest rates has worked as an effective policy in slightly reducing the U.S. Debt/GDP ratio over the past twelve months. Notably, even with the recent drop, the Debt/GDP ratio is still quite far from normal.

It is also notable that, during the 71 years covered in the chart above, a meaningful decline in the Non-Financial Debt/GDP ratio occurred only two times: in 1950 and 2021. Both declines occurred when inflation had accelerated into the high single-digits while bond yields remained in the low single-digits. When inflation-adjusted bond yields remain deeply negative, it’s harmful to fixed income investors but helpful for countries trying to reduce their debt leverage.

In 2022 and beyond, we do not know the timing of when inflation will accelerate and when it will decelerate, just as we did not know when house prices would finally decline or when subprime mortgage prices would decline as the housing bust manifested itself. With little respect to timing, we are generally constructing our client portfolios to make them more resilient to rising prices. This means less exposure to fixed income securities and more exposure to undervalued stocks, real estate, gold, and other assets that we believe should hold their value in an inflationary environment.

With inflation likely-to-remain high and bond yields likely-to-remain low over the intermediate period ahead, we are adjusting our investment strategy with your investment portfolio accordingly. If you would like to know more about how this applies to your portfolio in particular, please reach out to your portfolio manager to ask for an account review.

We said farewell to Erin Kelsey, our financial planning analyst, in recent weeks. Erin decided to make an industry change and took a job with Willis Towers Waters as an HR Consultant. We are grateful for the many contributions she made to the firm and to our clients’ financial plans during the past five years. We wish her all the best in her future career and have begun recruiting her eventual replacement.

We wish you and your families a happy, healthy, and prosperous 2022. Thank you again for the trust you have placed in us to manage your hard-earned capital.

Pekin Hardy Strauss Wealth Management

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only. The information and data in this article do not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. There is no guarantee that the types of investments discussed herein will outperform any other investments in the future. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Past performance is no guarantee of future results. The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics