“It’s no wonder that truth is stranger than fiction.

Fiction has to make sense.”

─ Mark Twain

Usually, when we write our quarterly investor commentary, we perform a deep dive analysis into one particular subject that offers long-term investment relevance for our clients. However, history has moved rather quickly across numerous fronts in the past 90 days, with many important investment implications. We thought it would be better to survey the landscape a bit more broadly this quarter to try to make sense of the tectonic changes that have transpired.

In late February, Russia unilaterally launched its invasion of Ukraine. While hoping that peace, calm, and diplomacy will ultimately prevail, we will let others comment on Russia’s military strategy and the likelihood of its eventual success.

From an investing standpoint, a far more transformative event than the invasion itself was the West’s economic sanctions against Russia in reaction to the invasion. The United States and the European Union swiftly applied a wide range of economic sanctions against Russia, affecting its banks, exporters, and oligarchs. At the same time, multinational corporations headquartered in the West, such as BP, Coca-Cola, and Visa, abandoned their Russian operations or announced intentions to divest from their longstanding Russian investments. The United States announced a ban on Russian energy imports, and the European Union is currently debating a ban on energy imported from Russia.

At the same time, the U.S. economy is experiencing a withdrawal in fiscal spending of more than $1 trillion, while the Federal Reserve is trying to tighten financial conditions aggressively. If the combination of a significant fiscal and monetary stimulus, known as “helicopter money,” is a sure-fire way to create inflation, we would assume that the opposite of helicopter money, which is what is happening today, would certainly be a sure-fire way to stop inflation. Perhaps the reason that stocks have not yet corrected further is that investors don’t believe that Congress and the Federal Reserve have the courage to remain austere for very long.

The long-term implications of these economic and financial events are numerous and wide-ranging. We expect history to document this period as a critical inflection point in economic history, with profound, long-lasting effects on global trade, energy security, inflation, interest rates, and the international monetary system.

- Foreign Reserves

Surprisingly, the West not only sanctioned Russian banks; it also sanctioned the Central Bank of Russia itself by freezing Russia’s foreign currency reserves. In our view, this surprisingly bold move was akin to dropping a financial nuclear bomb. Russia had generated these foreign currency reserves over many years by exporting its commodities. These foreign currency reserves are supposed to serve as an emergency fund for emerging market countries like Russia, allowing them to import food or energy or defend their currency in a time of need. By freezing Russia’s foreign currency reserves at precisely the time when Russia needed them the most to support the Ruble after its banks had been sanctioned, the West used a financial weapon of last resort.Freezing Russia’s foreign currency reserves sent a strong message not only to Russia but also to any country that might not be 100% aligned with the West, including China, Brazil, India, and Saudi Arabia. In recent months, these non-aligned countries have learned that they may risk having their foreign currency reserves frozen, too, if they were to behave in a way that the West doesn’t like. Unsurprisingly, some of these countries are now trying to figure out how to transact outside the U.S. dollar-based international monetary system. Saudi Arabia is working on an arrangement to sell its oil to China in Chinese Yuan, while India is working on a trade deal with Russia involving their respective local currencies. This acceleration in efforts to reduce the world’s dependence on the U.S. dollar to settle international transactions will also accelerate the dollar’s depreciation versus the value of the goods that it imports from other countries.

– - Oligarch sanctions

The West’s economic sanctions have not just been targeted against the Russian government. Governments across the West are confiscating assets from Russian oligarchs, many of whom have nothing to do with Russia’s decision to invade Ukraine. While nobody wants to defend the interests of Russian oligarchs, it is worth acknowledging the unintended economic consequences of these confiscation initiatives. Oligarchs from Russia, Saudi Arabia, the United Arab Emirates, China, Brazil, and other countries have been aggressively buying U.S. real estate over the last several decades. These purchases have raised the net worth of U.S. investors while also helping to fund the current account deficit of the United States. However, now that the West is seeking to freeze or confiscate the assets of Russian oligarchs, it is also likely that the uber wealthy from other countries will seek a store of value for their wealth outside the West in the future. This could reduce demand and may even increase the supply of real estate for sale in the United States, depressing real estate values and reducing demand for U.S.-based assets. With foreign demand for U.S. Treasuries and real estate diminished, what happens to the U.S. dollars exchange rate when foreigners decide that U.S. stocks are too expensive?

– - Inflation

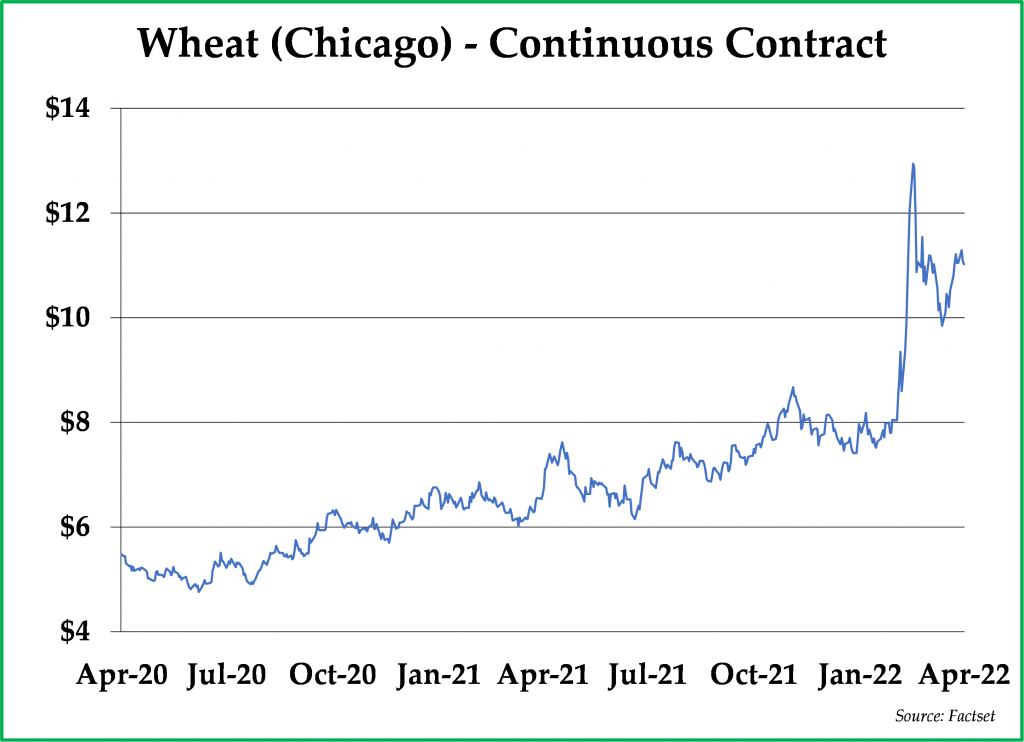

Inflation, already far too high before the war in Ukraine began, accelerated as the Russian tanks rolled across the Ukrainian border, particularly in those commodities which represent significant Russian exports, including oil, natural gas, wheat, and fertilizer. If Russian commodity exports are removed from the market or even limited, the result will likely be persistently higher prices across the global economy, particularly for energy and food. Additionally, as the breadbasket of Europe, Ukraine has essentially missed the spring planting system due to the war. As we are writing this letter, food riots have already broken out across several developing countries, such as Sri Lanka, Pakistan, and Peru, where impoverished families can hardly afford a 100% hike in the price of wheat compared to two years ago.

–

Wars often lead to rationing, price controls, capital controls, and trade controls, and the war on Ukraine has proved to be no exception. These controls will likely result in sub-optimal economic decisions and cause the global economy to operate with less efficiency and more inflation over the long term.

Setting the Ukraine war aside, we have argued that high inflation is here to stay. Our argument has nothing to do with geopolitics and everything to do with exceedingly loose fiscal and monetary policy employed to reflate the economy and reduce the sovereign indebtedness which has grown to be unsustainably problematic. The Ukraine war, in our view, represents both an inflation accelerant and a convenient political scapegoat for the inflation that politicians and central bankers are creating and should persist well after the Ukraine war ends.

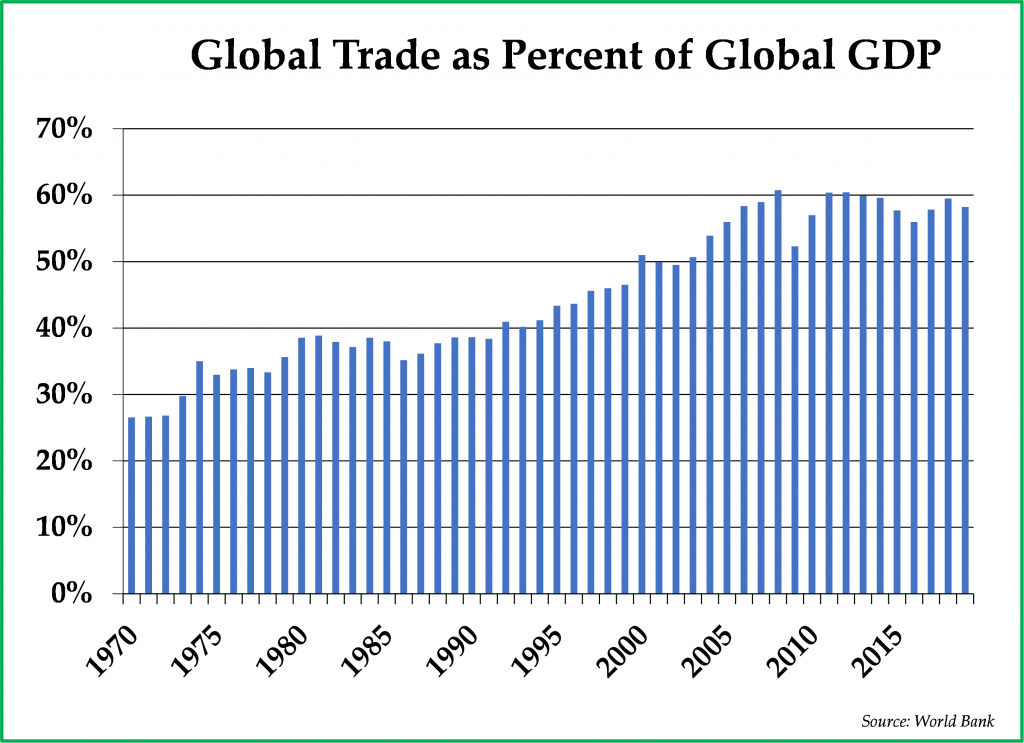

– - Deglobalization

In our view, globalization peaked a few years ago, and a multi-decade process of deglobalization has begun (see chart below). The coronavirus pandemic accelerated this process as governments realized that not having access to domestically manufactured medical supplies negatively influenced their abilities to respond to emergencies. Moreover, the semiconductor industry has taken on greater national security importance; several companies like Samsung and Intel have announced in recent months that they are building new manufacturing facilities in the United States in response to political pressure. As for energy, Russia’s invasion of Ukraine has now put energy security in the limelight for many countries.

–

In the 1970s, the Arab oil embargo caused governments worldwide to make plans to achieve energy independence. Governments wanted to power their economies without reliance on foreign energy imports. The oil embargo led to a nuclear renaissance for countries like Japan, Germany, and France, which relied heavily on energy imports. We expect that this geopolitical crisis will similarly accelerate plans to develop sustainable energy sources like wind, solar, and geothermal. It is also likely to result in additional domestic production of oil, natural gas, and coal not just from the United States but also from every country that has an option to do so. Furthermore, we would expect nuclear energy to receive increased attention; last month, U.K. Prime Minister Boris Johnson announced a new aim for the United Kingdom to generate 25% of its electricity from nuclear power.

– - Fiscal Policy

In 2020 and 2021, U.S. Federal spending exceeded revenues by more than 10% of GDP, with the Federal Reserve purchasing all of the Treasuries necessary to finance that deficit spending. It should be no surprise, then, that the Consumer Price Index recently exceeded 8.5%. With that said, inflation has become a significant political problem; Congress is set to spend more than $1 trillion less in 2022 compared to 2021. Lower spending should represent a considerable headwind to GDP growth in 2022. Despite rising prices, we believe the economy is cooling quickly due in part to this year-over-year decline in fiscal spending.

– - Monetary Policy

Like Congress, the Federal Reserve finds itself between a rock and a hard place. On the one hand, if the Federal Reserve doesn’t raise interest rates and tighten financial conditions, it risks letting inflation get even more seriously out of control. On the other hand, the U.S. economy has never been so indebted and financialized, particularly with respect to corporate debt and U.S. government debt relative to GDP. This indebtedness limits how many interest rate hikes the Fed can implement before causing problems in the stock market, the housing market, and the Treasury bond market.In addition, the Federal Reserve cannot mitigate a shortage of supply in commodities with monetary policy. The only lever that the Federal Reserve has to reduce inflation is taming aggregate demand, which means putting the economy into recession to reduce inflation. We believe this is very much the current game plan. Thus far, the Treasury bond market has reacted very poorly as interest rates have increased rapidly across the yield curve, while the stock market has remained sanguine. To put the bond market’s reaction in perspective, since the inception of the Bloomberg Aggregate Bond Index in 1978, the Index has never suffered an annualized loss on par with the over 8% loss sustained thus far in 2022.Are the bond markets leading the stock market? Only time will tell, however, we expect that the Federal Reserve will continue to hike rates and tighten monetary policy until the stock market and housing market correct or until the correction in the Treasury bond market becomes unbearable for the U.S. government. Based on the Treasury futures curve, investors expect over eight interest rate hikes over the next two years. We would be surprised if the Federal Reserve doesn’t choose to stop well before then due to the turmoil it will ultimately create in the financial markets.

In summary, a lot is happening right now. Our long-term outlook (5 years) has become more inflationary than it was 90 days ago, while our short-term outlook (6 months) for the markets has become more cautious due to the combination of fiscal withdrawal, monetary tightening, and the negative impact of quickly rising food and energy prices.

Let’s review some of the investment implications of these economic developments on various asset classes:

Fixed Income

Interest rates have increased at a rapid pace over the past ninety days as a result of three factors. First, inflation expectations have increased, causing bond investors to demand higher interest rates and push down bond prices. Second, the Federal Reserve is setting expectations for regular quarter-point interest rates over the next several years, which has caused 2-year Treasury bond yields to increase to 2.56%. Third, the Federal Reserve has stopped buying Treasury bonds, causing 30-year interest rates on Treasury bonds to rise to 2.88%. At the same time, the benchmark 30-year fixed mortgage is now 5.07%, well above the 3.20% rate that homebuyers enjoyed as recently as late December 2021.

As a result of these remarkable interest rate increases, the first quarter of 2022 was difficult for bond investors, as bond prices declined across all issuances. While generating negative returns for bond investors, higher interest rates also result in higher debt service costs for prospective households who use mortgage financing, corporations who have to issue corporate debt, and governments like the United States that need to finance their deficit spending plans.

Our clients generally own an underweight position in bonds compared to just a few years ago due to our view that bond interest rates do not adequately compensate investors for inflation. Rising interest rates do not make bonds attractive when inflation continues to exceed the interest rate paid on bonds significantly. We continue to seek out alternative investments as substitutes that might provide a better return for our wealth management clients.

Cash

Today, cash is a terrible long-term investment, given high inflation rates and near zero interest rates on money market funds, but it does offer optionality. When almost all financial assets are going down in price together, similar to what occurred in March 2020, those investors with cash were able to take advantage of incredible bargains. We may well be approaching another time when it could be useful to have an outsized cash position.

Equities

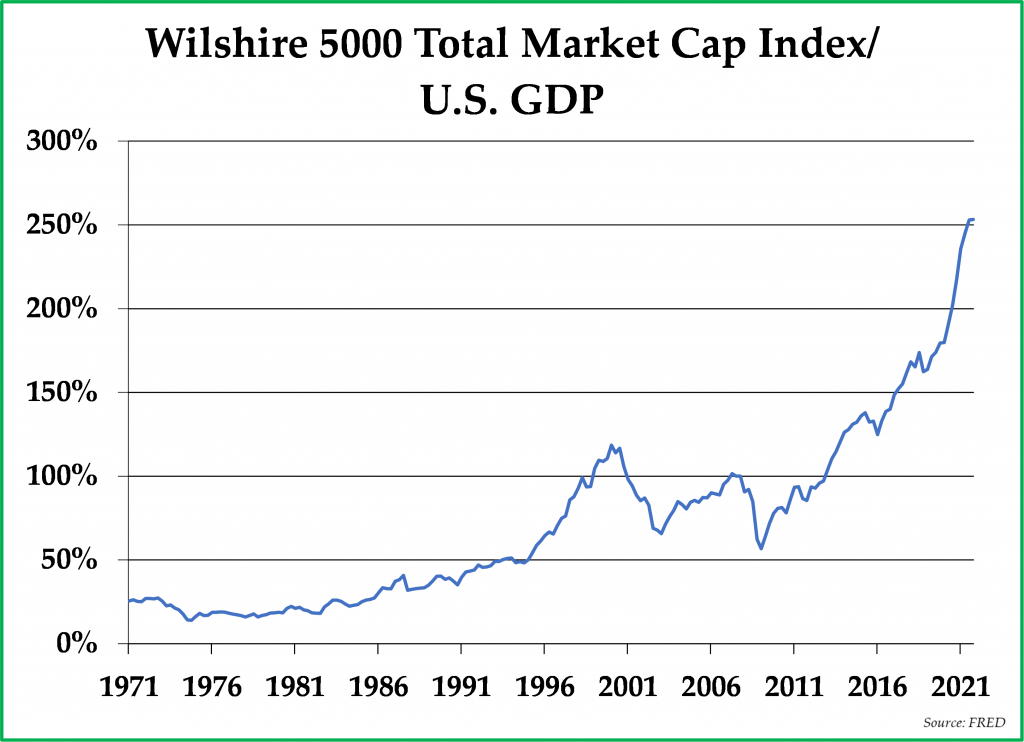

We mentioned the Arab Oil Embargo of 1973 earlier, which set the stage for higher oil prices and an inflationary environment that persisted for following ten years. During that decade, the U.S. stock market lost more than half of its value (adjusted for inflation) as corporate operating margins declined while Price/Earnings ratios compressed.

Worryingly, we are entering the current inflationary period at a time when the U.S. stock market is valued at a near-record high. In 2001, Warren Buffett remarked to Fortune magazine that the Market Cap to GDP ratio is “probably the best single measure of where valuations stand at any given moment.” By that measure, shown in the graph below, the U.S. stock market is currently at a record level in terms of being expensive and is orders of magnitude more expensive than it was when the Arab Oil Embargo occurred. The U.S. stock market index is unlikely to be a great place to hide from the bond market.

With that said, there were individual stocks that performed well in the 1970s, and we similarly expect that there will be individual stocks that will perform well over the next decade. The equities that should perform well are likely to be value stocks, commodity-related equities, and the shares of companies that have strong pricing power.

The Real Estate Market

We have been bullish on the U.S. real estate market during the past few years. However, we are becoming more cautious in the short term. Interest rates have risen very quickly, impacting the price new buyers will be willing to pay for real estate. Second, we expect that foreign demand for U.S. real estate will be diminished due to the asset confiscation efforts being applied to Russian oligarchs. Third, rising food and energy prices could make it more difficult for landlords to raise rents.

However, our long-term view remains bullish due to the strong fundamentals of this industry. Interest rates should remain well below the rate of inflation, which is an excellent environment for real estate investments that are financed with long-term, low-cost debt. An ongoing labor shortage should support persistent wage increases, which should allow for rents to continue rising. Increasing costs for labor, land, and materials should increase replacement costs for real estate, which would support real estate values. Finally, the United States now suffers from a structural shortage in housing after years of underbuilding following the Great Recession.

Gold

The price of gold has increased year-to-date in 2022 and helped offset the poor returns of fixed-income investments. As the economy continues to slow, we expect that investors will increasingly turn to gold as a safe-haven investment. Long-term Treasuries have not been working as a safe haven this year, which will likely cause even more investors to initiate new gold positions or increase their existing gold positions.

Recent geopolitical developments have increased the likelihood of rising gold prices. As countries move towards trading in local currencies, a neutral reserve asset will be necessary to offset trade imbalances. We expect that neutral asset to be gold, as central banks own it and have been buying more gold ever since the Great Recession. However, gold can only work as a neutral reserve asset with a much higher price than it has today. Just as gold outperformed all other asset classes during the inflation era of the 1970s, we expect gold to outperform all other asset classes during the coming inflationary decade.

******

We hope you are well and are having the opportunity to enjoy the warmer spring weather. We remain grateful as ever for the trust you have placed in us and for the opportunity to work with you in planning your financial future.

Sincerely,

Pekin Hardy Strauss Wealth Management

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually Past performance is no guarantee of future results. The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The Bloomberg US Aggregate Bond Index is a broad benchmark index for the U.S. bond market. The index covers all major types of bonds, including taxable corporate bonds, Treasury bonds, and municipal bonds. The Wilshire 5000 Total Market Index is a market-capitalization-weighted index of the market value of all American-stocks actively traded in the United States.