I Bonds are a low risk fixed income product sold directly from the U.S. government and currently pay a high rate of interest (6.89%). While investors must purchase this product directly from the government and purchase amounts are limited, these products can be an attractive, low-risk partial hedge against inflation.

What is an I Bond?

An I Bond is a low-risk savings product sold by the U.S. Treasury that combines fixed rates with variable rates based on the prevailing rates of inflation. The inflation rate for these Bonds is reset every six months. The current rate for I Bonds purchased from November 2022 to April of 2023 is 6.89%. In this Navigator, we provide an overview of the components of an I Bond, the rules regarding their purchase, where to buy them, and, finally, the redemption process.

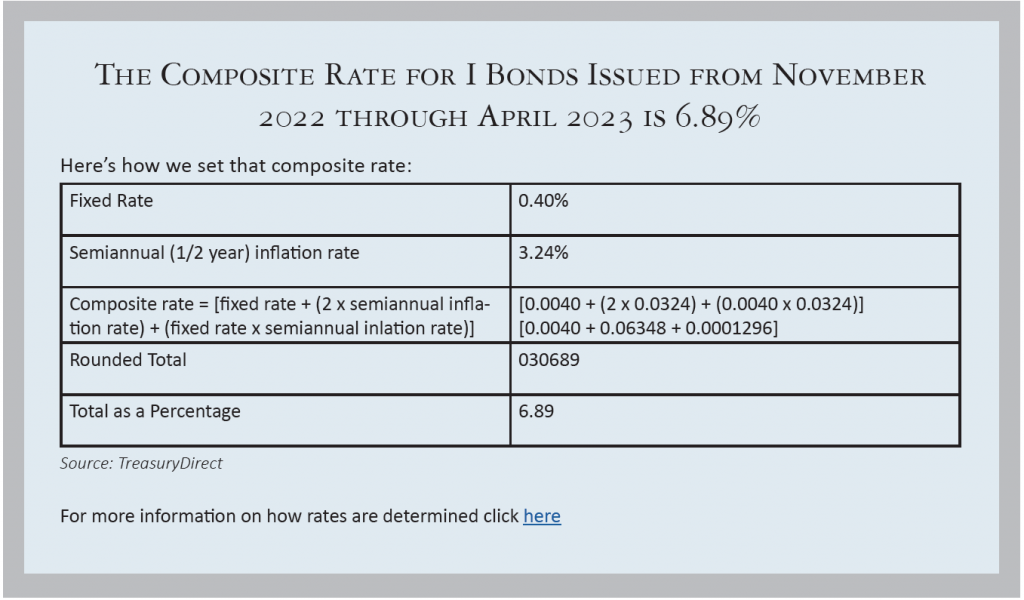

How are Rates Set?

Interest on I Bonds is compounded semiannually, meaning that every six months from the bond’s issue date, the interest the bond earned over the previous six months is added to the bond’s principal value. This creates a new principal value upon which the next six months of interest will then be earned.

The actual rate of interest of an I Bond, also known as the composite rate, can be found by combining the fixed rate and the inflation rate. The composite rate for an I Bond can never be less than 0 percent, but it can be less than the fixed rate if inflation is negative.

Fixed Rate:

You are given the fixed rate of interest that the I Bond will receive when you buy it. Because it is fixed, this interest rate will stay the same through the maturity of the bond. The Treasury Department determines the fixed rate for I Bonds every six months. The rates are announced on the first business day in May and the first business day in November. The fixed rate then applies to all I Bonds issued throughout the following six months.

Inflation Rate:

The inflation changes regularly. However, the inflation rate used to compute investor rates of return, liked the fixed rate, is set on the first business day of May and November. The inflation rate is based on changes in the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy. These changes are applied to the bond every six months from the bond’s issue date. For example, if the I Bond was issued in July of 2022, the change in the inflation rate would be applied in January of 2023.

To get a better understanding of how the composite rate is determined, consider the following example:

Purchasing I Bonds

Unfortunately, we cannot purchase I Bonds for your Pershing or Schwab portfolios on your behalf. Electronic I Bonds can be purchased directly from the Treasury through their online program TreasuryDirect.

You can also purchase paper I Bonds using your Federal income tax refund. When filing your tax return, IRS Form 8888 must be included. In part 2, it will ask the amount you wish to purchase for yourself and spouse (if jointly filed) or someone else. No TreasuryDirect account is needed for paper versions, and your paper bonds will be sent via mail once your tax return is processed. Keep in mind that purchase amounts must be in increments of $50 if purchasing $250 or less. If more than $250 are purchased, $50 increments will be used up to $250 and the fewest possible number of additional bonds for the remainder. For example, if you buy $1,000 in paper I bonds, you will receive six $50 bonds, one $200 bond and one $500 bond.

For more information on paper, I Bond buying click here.

In any single calendar year, a total of $5,000 worth of paper I Bonds and $10,000 worth of electronic I Bonds may be purchased. These limits are applied per Social Security Number of the first person named as the owner of the bond, for a business entity, trust, or per Employer Identification Number (EIN). The limit applies to both bonds bought for yourself as well as those gifted to you. However, there are two exceptions:

- If I Bonds are transferred to you due to the death of the original owner, the limits do not apply.

- If a paper I bond issued before 2008 is under your control, you can convert it to an electronic I Bond in your account in TreasuryDirect regardless of the amount.

How Can I Bonds Be Redeemed

An I Bond is a 30-year bond that has a minimum term of ownership of one year. After one year from issuance, the bond can be cashed out. However, there are early redemption penalties if the bond is redeemed before five years of ownership. If the bond is redeemed before it has been held for five years, the holder will forfeit the last three months of interest.

If you hold an electronic I Bond, you can redeem a minimum of $25 or any amount above that in $0.01 increments (25.01, 25.37, 25.82 etc.…). If you do not redeem the bond in full, you must leave at least $25 worth of I Bonds in your account. The redemption is comprised of principal and interest. In the case of a partial redemption, only the interest is paid on the partial amount cashed. Electronic bonds can be redeemed by logging into your TreasuryDirect account and using the link in ManageDirect for cashing securities.

As for paper bonds, local banks have varying policies on how much they will cash in a single transaction, with some refraining from cashing savings bonds entirely. An easy way to cash a paper I Bond is to send the request to Treasury Retail Securities Services with FS Form 1522. They will cash them regardless of the value, assuming the minimum holding period requirements are met. An important thing to note with paper bonds is that they may not be split and must be redeemed in full.

If you hold an electronic bond in TreasuryDirect, you can find the bond’s current value there. Use the “Current Holdings” tab inside your account to find this information. For a paper bond, you can use the Savings Bond Calculator.

You can find more information on I Bond redemption here.

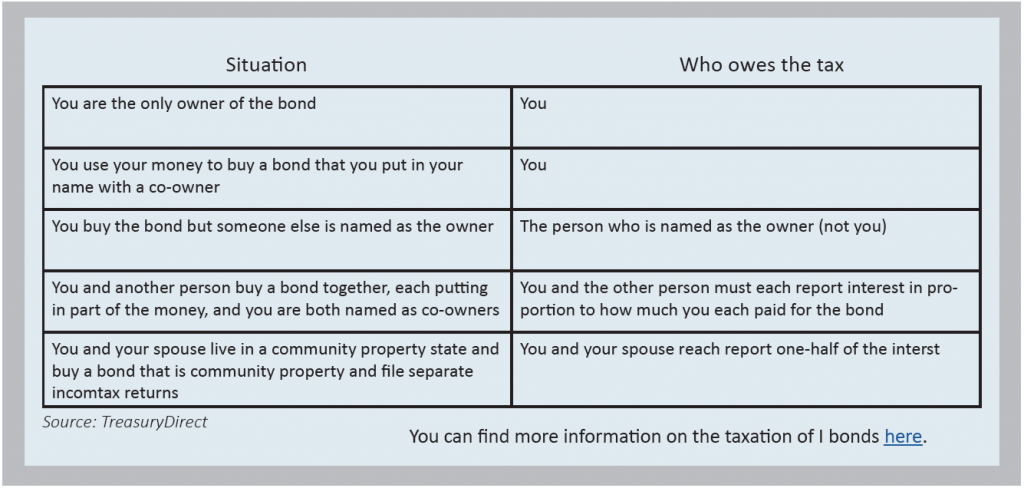

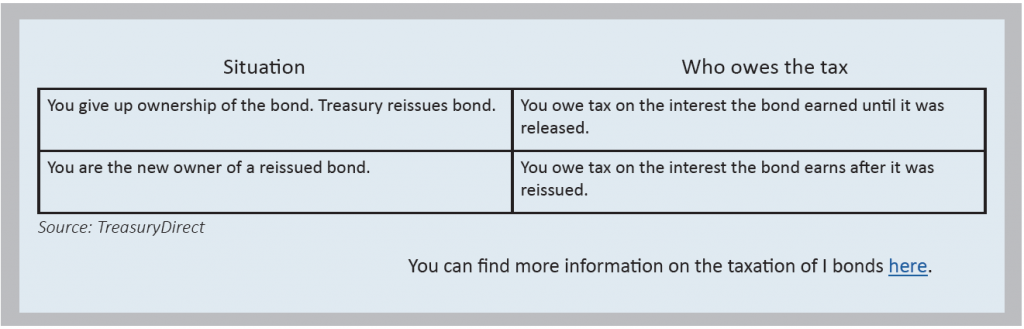

How Are I Bonds Taxed

The interest earned on an I Bond is taxed at the Federal level; however, it is not subject to state and local taxes. I Bond interest is subject to any applicable federal estate, gift, and excise taxes, along with applicable state estate or inheritance taxes. If the money is used for higher education costs, Federal taxes may be avoided.

As for reporting interest, there are a few options. The holder may report the interest every year or the holder may choose to defer the reporting of the interest until Federal income tax return time in which the first of the listed events occurs:

- The bond is redeemed, and the holder receives what the bond is worth, including interest.

- Ownership of the bond is given up and the bond is reissued.

- The bond does not earn interest because it has matured.

You should consult with your accountant if you have questions about how taxes might affect your investment in I Bonds.

Our Recommendations With Regard to I Bonds

I Bond purchases should be considered on an individual basis after considering the pros and cons of the investment. The pros and cons as we see them are listed below:

Pros:

I Bonds have virtually no risk of loss of principal due to them being backed by the U.S. Government. At current rates, an I Bond is earning significantly higher rates than other low risk savings products such as high-yield savings accounts and CDs. This product can be used as a partial hedge in a high inflation environment and are a tax efficient savings product.

Cons:

Liquidity risk is an important matter when purchasing I Bonds. I Bonds are subject to a minimum holding period of one year and any redemption before five years is subject to forfeiting its’ previous three months of interest. Therefore, if the funds are needed in the short to mid-term, it may not make sense to purchase the bond. I Bonds cannot be purchased or held in retirement accounts. For high-net-worth individuals, I Bonds might not be as practical because of the low purchase limits and the time-consuming challenges of the purchase process. For example, in a 5-million-dollar portfolio, a $10,000 purchase of I Bonds only accounts for 20 basis points or .20% of the portfolio. Finally, the variable rate nature of I Bonds can lead to a decreased return when inflation starts to decline.

After all things considered, if you do not feel comfortable making the decision yourself, reach out to your advisor. We will review your financial goals and portfolio positioning to assess the decision and do our best to answer any uncertainties.

The commentary in this video and article was prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only (and is not intended as an offer or solicitation for the purchase or sale of any security.) The information and data in this article and video do not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report and video, and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of individual holdings, market sectors or any particular strategy, there is no guarantee that the strategies discussed herein will outperform any other. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. The Consumer Price Index for All Urban Consumers (CPI-U) is a monthly measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services, based on the spending patterns of urban consumers.