“You can never predict how (the) market will react. You can model it. You may try to predict it, but weather and markets and risk, only God knows because only he has seen tomorrow.”

─ Rakesh Jhunjhunwala

We do not have a crystal ball to understand the future, and, if we had one, it would be even more cloudy than usual. Nevertheless, we are going to share some of our predictions about how 2024 might unfold. While this exercise of writing down some of our thoughts about the year is quite useful for us, we want to warn you that many of these predictions will turn out to be incorrect.

Before sharing our 2024 predictions, we want to revisit our 2023 predictions, some of which played out as forecasted, but many of which turned out to be incorrect. Overall, 2023 turned out to be a strong year for the capital markets, especially compared to a dismal 2022, despite still-elevated inflation, increased geopolitical turmoil, and softening in the labor market.

Let’s start with our incorrect 2023 predictions. We were mistaken in our call for a 2023 recession, as the coming recession has been slower to arrive than we expected due to significant and growing Federal deficit spending. We were also wrong that food and energy inflation would continue, as oil and grain prices declined in 2023, due in no small part to the Biden Administration selling a record amount of oil out of the U.S. Strategic Petroleum Reserve. Our expectations for a weak U.S. stock market did not occur, as equities generated strong returns due to lower commodity prices and increasing investor hopes for a soft landing in the economy. We also expected a standoff with newly arranged borders in Ukraine; while it appears likely that prediction most likely will happen, it didn’t happen in 2023.

The rest of our 2023 predictions were more on the mark. We correctly predicted that the Federal Reserve would pause and then pivot in its monetary tightening campaign. It has paused further interest rate hikes, and Federal Reserve Chairman Jerome Powell even indicated that the next move would likely be an interest cut. It also flooded the banking system with additional monetary liquidity in 2023 to alleviate stress after several rather unique bank failures. Bond yields declined, as we predicted, supporting the housing market, also as we predicted. We expected that the office real estate market would remain distressed, and it did, and that Congress would raise eyebrows with its deficit spending, and it has. A renaissance in nuclear energy appears to be unfolding not just in the United States, but worldwide, as demonstrated by the 90% increase in the spot price of uranium in 2023.1 Finally, we expected an increase in the proportion of global trade occurring outside of the dollar, a strong rise in the price of gold, a decline in the trade-weighted value of the dollar, and good performance in emerging markets, all of which happened in 2023.2

The most challenging aspect of making these predictions and writing them down is that it demonstrates to us and our clients very clearly that our view of the future will invariably be faulty, and especially so when it comes to the short-term timing of macroeconomic events, such as the beginning of a recession, the end of a war, or the bottom of a bear market in stocks. Accordingly, we keep our client portfolios diversified, invest with a long-term perspective, and do not act on short-term predictions, which means that we own stocks, even if we expect headwinds for stocks, and we would sell an overvalued energy company, even if we think energy prices will rise. Our best work is done when we find fundamental stock-specific mispricings in the market and act upon them. In such cases, where we have an adequate margin of safety in the share price when we invest, we hope to generate a profit for our clients even when one or more of our predictions do not pan out as expected.

Now let us move on to 2024; we share below the list of our 10 predictions for 2024, knowing all too well that several of these will prove to be incorrect.

1. Inflation Reaccelerates

Inflation as measured by the Consumer Price Index (“CPI”) decelerated through 2023, although it never reached the Federal Reserve’s 2% inflation goal. Due to the strength of the stock market in 2023 and Chairman Powell’s suggestion in December 2023 that the Federal Reserve might start to ease monetary policy, inflation reaccelerates. The dollar depreciates versus other currencies and versus commodity prices. The price of oil surges once again as geopolitical turmoil and steadily growing global demand pushes up against constrained supply. With a presidential election coming in November, the Biden Administration struggles trying to explain to voters why high inflation persists.

2. The Yield Curve Steepens

The Treasury bond yield curve de-inverts as long-term interest rates rise due to increasing inflation expectations, even while short-term interest rates decline due to anticipated cuts in the Federal Funds interest rate. The Federal Reserve eventually cuts rates, but somewhat later than consensus expectations. Banks and other financial stocks have a volatile but decent year as pressures on customer deposits lessen.

3. The Israel-Hamas War Ends

The war between Israel and Hamas ends with a somewhat Pyrrhic military victory by Israel, and the United Arab Emirates lead a pan-Arab consortium to take over the rebuilding of Gaza’s infrastructure and political institutions. A quasi-Marshall Plan is put together to transform Gaza and allow it to properly rejoin the world economy. At the same time, thousands of Gazan refugees are resettled in the United States, Canada, and Europe, even while Jordan, Egypt, and other neighboring Arab nations refuse to accept a single refugee.

4. A New War Begins

Beyond the already existing wars in Eastern Europe and in the Middle East, we think there is likely to be a new war that could begin in 2024. Our best guess is that Houthis of Yemen will attack the U.S. military, prompting a new military conflict between the United States and Iran. If this scenario transpires, oil prices could spike up to $150/barrel in part due to the closure of the Strait of Hormuz. In addition, military spending would reaccelerate, and the United States military would solve its recruitment problems. The Biden Administration could also accuse Iran of creating higher inflation in the United States.

5. The Nuclear Renaissance Continues

Nations across the world join the unfolding nuclear renaissance by voicing official support for nuclear energy, causing spot uranium prices to continue to rise. “Energy independence” becomes an important national goal again for many countries that typically rely on energy imports to fuel their economies. The list of countries announcing new nuclear power plant projects includes the United States and a handful of Western European countries seeking to find a long-term, reliable, inexpensive, carbon-free replacement for Russian natural gas. The mainstream media begins publishing more stories about the climate change benefits of nuclear energy.

6. Gold Quietly Reaches a New All-Time High

Gold priced in U.S. dollars rises over 10% in 2024 and breaks out to new all-time highs on the heels of the start of an upcoming interest rate easing cycle, continued foreign central bank purchases of gold, and the depreciation of the U.S. dollar. Nevertheless, most investors and the financial media are focused elsewhere, and especially on the bitcoin price, which rises above $75,000. Gold inventories in New York and London continue to decline, offset by inventory increases in Shanghai and Dubai.

7. U.S. Stocks Languish

Foreign equities outperform U.S. equities in 2024 due to a depreciating dollar and Japanese investors repatriating their money back home due to rising interest rates in Japan. As inflation in the United States reaccelerate, stocks become pressured as investors fear that higher costs will result in lower corporate profit margins for most businesses. The share prices of the Magnificent Seven (Microsoft, Apple, Alphabet, Nvidia, Meta, Tesla, and Amazon), which truly were magnificent in 2023, begin to experience a mortifying decline during 2024.

8. Value Stocks Outperform Growth Stocks

On the back of a 1999-like year for growth stocks in 2023, growth stocks hit the wall in 2024. Price-to-earnings valuation ratios compress, which especially affects those stocks that began the year with excessively high valuation ratios. Value stocks, in the meantime, benefit from rising commodity prices and a de-inverting yield curve. The S&P 500 Index posts a mediocre year during 2024, due to its severely overweight exposure to growth stocks generally and the Magnificent Seven specifically.

9. Home Prices Remain Resilient

Home prices nationally seem to hold up during 2024. There are certain pockets of housing decline, such as areas where investors were purchasing homes aggressively to generate income via short-term (Airbnb) rentals, but the broader housing market remains buoyed by a lack of supply and reaccelerating rental trends.

10. Commercial Real Estate Remains Distressed

Commercial property prices continue to decline due to persistently low occupancy rates in downtown offices combined with a persistently challenging funding environment. Bankruptcies increase along with firesale prices of distressed properties and the distressed debt of those properties. Unsophisticated investors in limited partnerships run by amateur operators discover that real estate is not a one-way ticket to guaranteed positive returns.

The year could turn out to be better than these predictions might suggest; on the other hand, it could turn out to be worse. During election years, as would be the case in 2024, it is often a good time to be more aggressive. On the other hand, 2008 was an election year, as was 2020. If these years are any indication of what to expect in 2024, it makes sense to hold a lot of cash, short-term Treasuries, and gold in preparation for volatile markets. Moreover, we think there is an excessive amount of greed in the market and not enough fear. In addition, during periods of persistent, elevated inflation, such as is also the case now, it’s often a good time to own an oversized position in commodities and other hard assets.

Most importantly, one year is not a particularly long investment time horizon. Our investment approach is long-term and guided by fundamental factors that go far beyond 2023, such as:

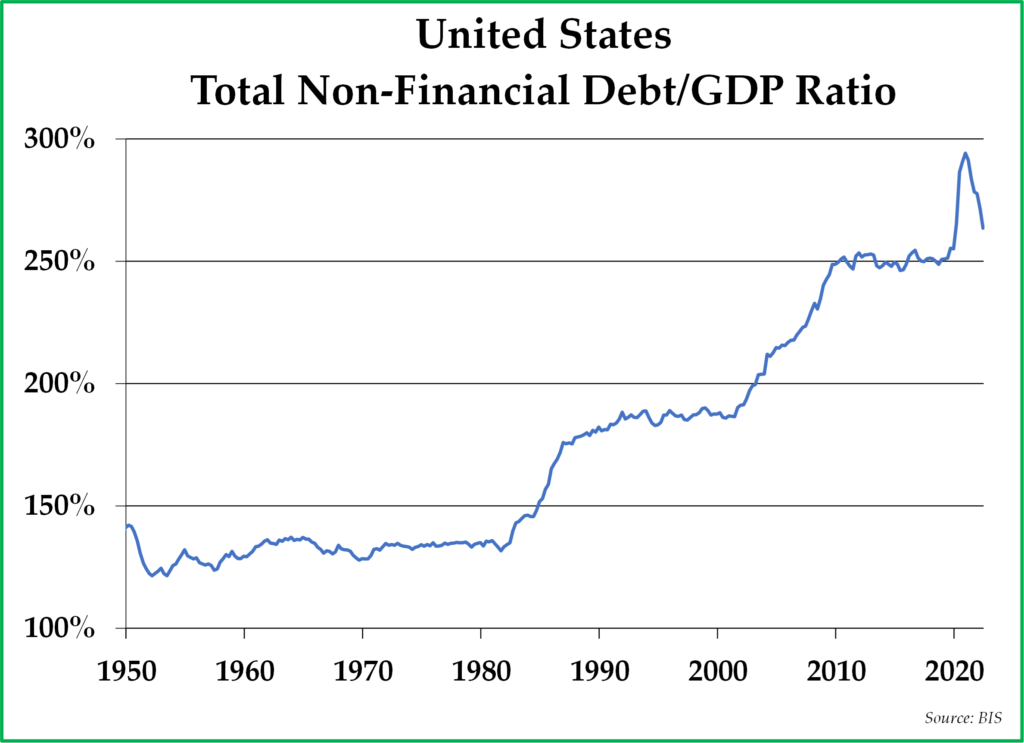

• U.S. indebtedness across the household, corporate, and government sectors is at record high levelsWorking off this debt will require time, elevated inflation, low real (inflation-adjusted) interest rates, and debt restructurings.

• The global economy remains in the early innings of a secular bull market in commodity prices that began in 2020. In 2023, oil and food prices declined, but gold, silver, and uranium prices climbed well above the inflation rate. Commodity bull markets usually last a decade or more and do not end until companies over-invest in future commodity production. If anything, companies today continue to underinvest in future production, opting instead to use their free cash flow to buy back stock or make acquisitions.

• U.S. stocks, and particularly the large-cap growth stocks that dominate the S&P 500 Index, remain expensive relative to history and have room to deflate. It is likely to be a good time to be a stock picker, and it is likely to be a poor time to own passive indices of U.S. stocks.

•The dollar remains an expensive currency, even after its trade-weighted decline during 2023. Should it continue to depreciate against foreign currencies, as we expect it will, it means that stock markets outside the United States are likely to outperform U.S. stocks. For this reason, we have been seeking to expand our clients’ asset allocations to foreign stock markets.

While our predictions might change from one year to the next, our investment strategy remains the same. We pay strong attention to value, seeking to purchase investments that we believe are temporarily undervalued by Mr. Market. In addition, we pay strong attention to the fundamental factors of the long-term investing environment, which we tried to describe at the end of this letter, and we invest accordingly. Finally, we take a disciplined and prudent approach toward our client portfolios, seeking to place more emphasis on the return of our clients’ capital than on the return on our clients’ capital.

*****

We wish you and your families best wishes for a happy, healthy, and prosperous 2024. We appreciate your trust in our stewardship of your capital and will be working very hard during the coming year to maintain that trust.

Sincerely, Pekin Hardy Strauss Wealth Management

1 Source: Cameco.

2 The Wall Street Journal recently reported that an estimated 20% of global oil was bought and sold in non-dollar currencies during 2023, up from near 0% just a few years ago.

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy, focusing on the large-cap segment of the market. The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics.