“The cure for high prices is high prices.

The cure for low prices is low prices.”

─ James Ernest Boyle

Speculation and the Chicago Board of Trade

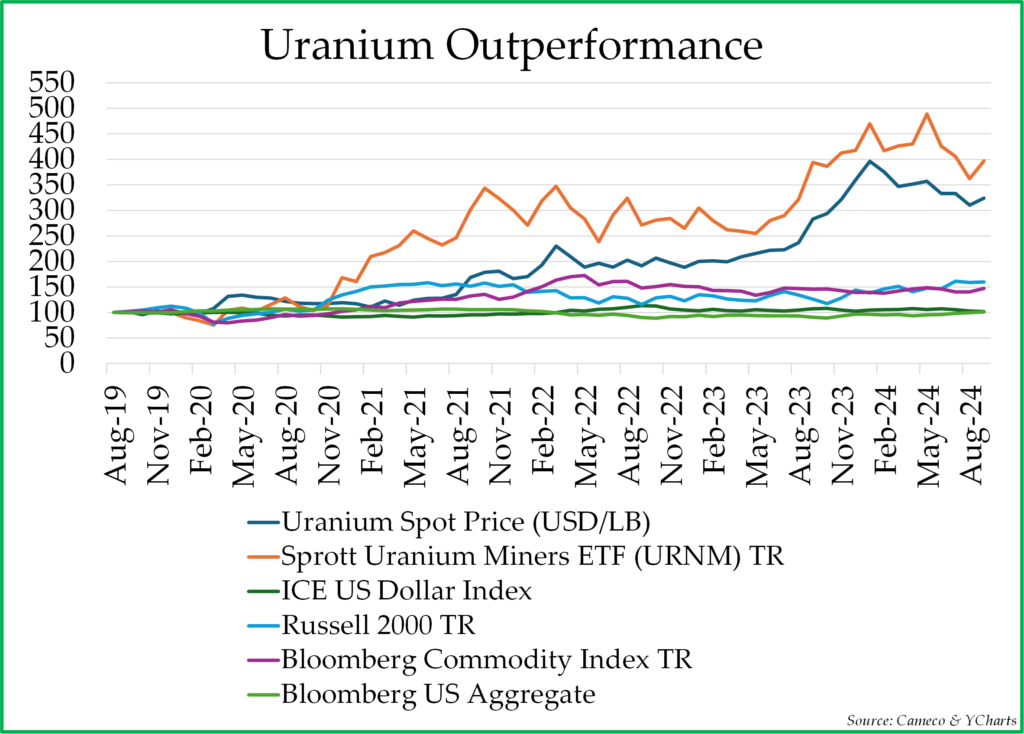

After many years of unsustainably low prices for physical uranium, or perhaps as a reaction to these low prices, the fundamental medium-term to long-term outlook for higher uranium prices has never been more promising. Uranium prices have increased significantly over the last 5 years, but there are good reasons to believe that the bull market in uranium prices is still in the early innings due to a structural supply deficit that is likely to persist over the coming decade. With higher prices for uranium, we would expect increasing profits for nuclear power plant builders and uranium miners, along with higher share prices for these businesses.

To meet the future demand growth from emerging markets, data centers, and electric vehicles, while fulfilling ambitious climate goals, the nuclear energy industry is making plans to fulfill a pledge (COP28) that will triple nuclear energy production by 2050.1 This is a dramatic improvement from the nuclear energy outlook just a few years ago when many EU countries were looking to phase out their nuclear programs and that Japan shut down many of its reactors in the wake of the 2011 nuclear accident at the Fukushima nuclear plant. The demand growth trajectory for uranium is accelerating at the same time that its supply outlook is becoming increasingly more precarious. With the uranium price remaining too low to incentivize additional greenfield development projects, risks remain skewed heavily to the upside for prices. While forecasted demand growth is increasing for uranium, the forecasted supply of uranium has instead experienced downward revisions, as the uranium price remains too low to incentivize additional production. Important to note, the cost of physical uranium represents only ~14% of the total cost to produce electric energy at a nuclear power plant.2

Dramatically Increasing Demand for Nuclear Energy

The drivers for increasing demand for nuclear energy are, first and foremost, dramatically increasing demand for electricity. World GDP continues to increase, and emerging market countries continue to get richer. With increased wealth, emerging market consumers are using more electricity.

In addition, new technologies are driving increased demand for electricity.

- Data centers are driving significant demand growth for electricity; in the United States, power consumption from data centers is forecasted to increase from 3% today to 8% of total power consumption by 2030.3 If demand for artificial intelligence (AI) meets investors’ lofty expectations, it is quite likely that data centers representing 8% of total power by 2030 could turn out to be low.

- Electric vehicles and plug-in electric hybrid vehicles are replacing internal combustion vehicles around the world, which should reduce the demand for oil but greatly increase the demand for electricity.

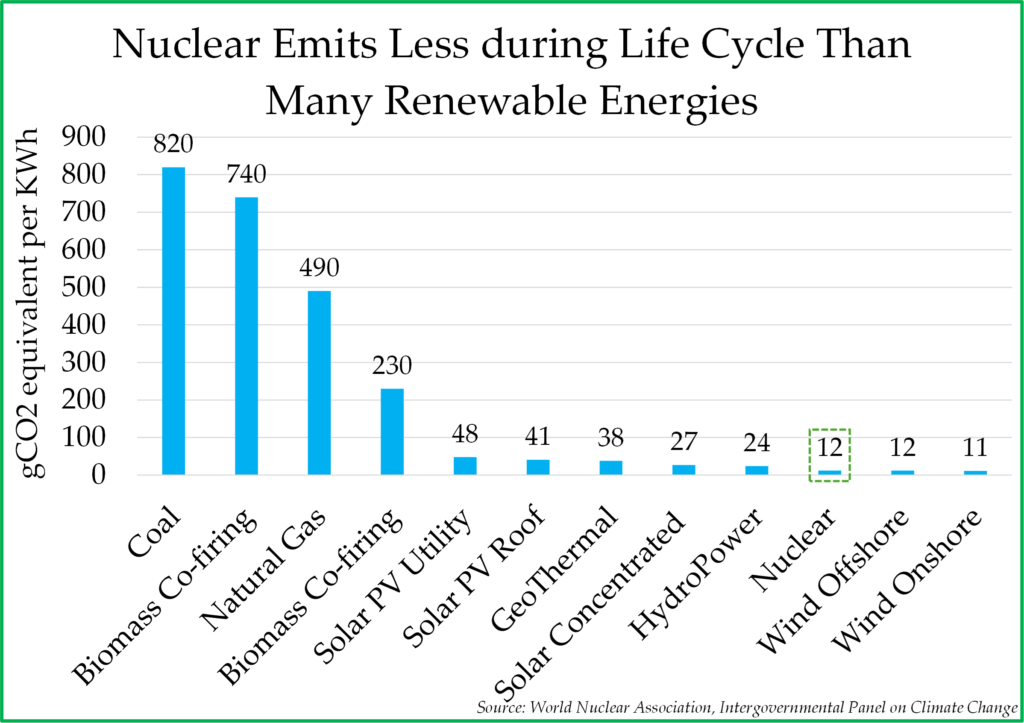

To fulfill this growing demand for electricity, nuclear power is well positioned as an energy source. Unlike coal, oil, and natural gas, all of which are used to fuel power plants and generate electricity, nuclear power carbon emissions are de minimis. For that reason, regulators and legislators around the world are expanding nuclear power capacity. Also, for countries like Japan, which are bereft of fossil fuel resources, nuclear energy represents energy security and independence, which is becoming increasingly important as geopolitical risks increase. Moreover, unlike intermittent renewables such as wind and solar, nuclear energy is consistent and reliable as a baseload energy source; one can operate a nuclear power plant when the wind is not blowing and after the sun has set. As a power source, nuclear energy has a reliability, cost, and carbon-free profile which is simply unmatched by any other source.

As a result, according to public capacity expansion and life extension announcements tracked by the World Nuclear Energy Association, nuclear plant capacity should expand from 390 GW today to 552 GW by 2035.4 The following are some examples of recent nuclear capacity expansion announcements on a country-by-country basis:

- China has approved the construction of 46 new nuclear plants during the past 5 years. By 2030, China will be the largest nuclear energy producer in the world with over 113 GW of electricity generated, using 56 million pounds of uranium each year, roughly double what China is consuming today. Moreover, China expects to approve more reactors in the future, targeting a nuclear fleet that will require 90 million pounds of uranium each year.

- The United States passed the ADVANCE Act on a bipartisan basis in July 2024, which will make it easier to achieve the U.S. Energy Department’s goal of tripling nuclear capacity by 2050 to 200 GW in order to meet emission goals. Thus far in 2024, many announcements have been made related to a) nuclear plant life extensions, such as the North Anna Power Plant in Virginia; and b) restarting closed nuclear plants, such as Michigan’s Palisades power plant and the Pennsylvania’s infamous Three Mile Island nuclear reactor.

- India has announced plans to triple India’s nuclear capacity from 8.2 GW to 22.5 GW by 2031-2032 and to 100,000 100 GW by 2047.

- Russia announced plans to double its nuclear power capacity over the next 18 years.

Inadequate Supply for Uranium

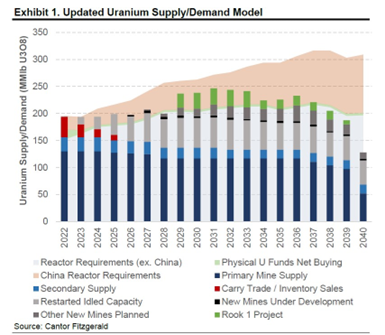

Given all the costs and challenges required in adding new uranium mining capacity, the supply of uranium is not growing at the pace required to meet future expectations of sharply higher demand for uranium. There is some capacity expansion activity, to be sure, just not enough. Without a change in the supply growth trajectory, it seems likely that supply will fall short of meeting expected demand, given the current price of uranium.

The key phrase in the above paragraph, of course, is “given the current price of uranium.” When the price of uranium is too low, as it is now, uranium producers are not able to develop new uranium mines at a satisfactory profit. Therefore, it seems likely, in our view that the price of uranium must increase materially from current levels, either gradually or suddenly. And, if that happens, any investor who owns uranium should enjoy price appreciation on their investment, and any investor who owns uranium producers should profit from growing profitability and investor expectations for more profits in the future.

The problem of inadequate supply growth is made worse by the fact that current uranium mines are suffering from production shortfalls. Kazakhstan-based Kazatomprom, the largest uranium miner in the world with more than 40% of the world’s proved reserves, lowered its 2025 production forecast by 17%, representing a shortfall of 14 million pounds, or 10% of expected world uranium production.5 And the problem is not just limited to 2025; this will be the fifth consecutive year when Kazatomprom missed its production targets. These shortfalls relate to cost escalation, increased government royalties, rising sanctions on countries aligned with Russia, and lower profits on uranium mining activity. Lower prices are resulting in lower production which will eventually cause shortages that drive up the price of uranium. As James Ernest Boyle eloquently put it over a century ago, the cure for low prices is low prices.

We are aware of several major new mines that are being built, but those projects are suffering from delays, financing challenges, construction problems, and generally higher costs than originally projected. There is simply not enough profit associated with the current uranium price to incentivize the kind of risk-taking on the supply side that is necessary to match the tsunami of demand that should be arriving in the coming years.

This structural supply deficit should set the stage for higher uranium prices until the structural supply deficit disappears as new mines come online to take advantage of those higher prices. The chart to the right beautifully demonstrates why a structural supply deficit will exist in the uranium market for years to come unless the uranium price increases.

Era of Inflation

For reasons that we have discussed at length in other quarterly letters, we expect persistently high inflation during the 2020s, driven by unsustainably high government deficits financed by unprecedented fiat money printing. While inflation has cooled compared to 2022, we expect the decline in the inflation rate will be a temporary phenomenon.

If our inflation outlook is correct, investments in scarce, hard assets should outperform. Uranium is certainly scarce, and we believe that it is only going to become increasingly more scarce. While printing more money is easy, producing more uranium is risky, costly, and difficult. And, for a nuclear power plant, there are simply no substitutes for uranium. A plant operator will seek to obtain uranium at any cost to prevent a nuclear reactor, which has very large fixed costs, from going idle. The scarcity of uranium, along with the fact that uranium is a small percentage of the total cost of operating a nuclear reactor, makes uranium and companies that benefit from increasing uranium prices an attractive investment, in our view.

Moreover, uranium is still under-owned by investors. While almost every investor has direct or indirect exposure to AI-related companies such as Nvidia, Alphabet, or Microsoft, their share prices already reflect a coming rosy future for AI, in our view. Meanwhile, the companies that directly or indirectly provide the necessary energy to accommodate all of the data center growth required for AI are mostly ignored and under-owned by investors.

Investment Implications

As a result of the coming nuclear renaissance, we foresee continued announcements of new nuclear reactors being built, existing nuclear reactors receiving life extensions, and closed nuclear reactors being reopened. Just as nuclear energy use increased dramatically in the 1970s in response to the oil crisis, we expect a similar dramatic increase in the 2020s. We have been investing in companies that benefit from this trend, and we are looking for others.

At some point, it will become increasingly evident that the demand growth for uranium is far outstripping supply growth. When this happens, the uranium price should increase, perhaps dramatically, and those companies and countries who have not maintained a sufficient safety stock of uranium will be forced to pay exorbitant prices to keep their reactors operating at capacity. We believe that investors in physical uranium trusts, which include many of our clients, should benefit from these price increases.

With increased uranium prices, mines will become more profitable, and the share price of mining companies should increase sharply. Increased profits will attract competition and new entrants, resulting in new mines, more production, an eventual end to higher uranium prices, and possibly the beginning of a decline in uranium prices. But we are probably still a decade away from such a time. In the meantime, many of our clients have investment exposure to companies that are involved directly or indirectly in uranium production.

*****

We believe that we have the best clients in the world. We are so grateful for your trust, your patience, and your willingness to allow us to allocate capital to unconventional investments and unconventional themes that may not be in others’ investment portfolios. We work hard every day to continue to earn that trust.

Sincerely,

Pekin Hardy Strauss Wealth Management

Sources

3 https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

4 World Nuclear Energy Association

5 Kazatomprom’s uranium production in 2025 should actually increase slightly v. 2024 levels but will nonetheless fall short of its prior output goals for 2025 by a wide margin via Kazatoprom company statements

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Pekin Hardy holds Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Kazatomprom (KAP.IL) and other companies mentioned in this edition in some of its client accounts.