Investors who also wish to be donors likely have more options for making tax-efficient donations to charity than they realize. This Navigator provides an overview of what assets to give and the existing alternatives for how to give them.

Giving Strategies for the Charitably-Minded Investor

For those investors who make charitable giving a regular practice, it may be natural to simply write a check or donate online to their favorite nonprofits. However, those who have the capacity to make larger one-time gifts or to make gifts of portfolio assets rather than cash will find themselves with a number of giving options that may make their gifts more tax beneficial, help with estate planning, or even provide an income stream for themselves or their heirs.

In this Navigator, we suggest a strategy for choosing assets to donate and then provide an overview of a number of giving vehicles and options available to the charitably-minded investor.

What To Give

While it may be easy to donate to your favorite nonprofits via check or credit card, making a gift in cash may not be the most tax-efficient way to give. Nonprofits, especially sizable ones, are able to accept donations of other types of assets, including real estate and investments. For those with assets that have significantly appreciated in value, making a gift of these assets can benefit the nonprofit and may have a significant tax benefit for the donor because nonprofits do not pay capital gains taxes.

Consider an example: say a donor who typically pays a 20% capital gains tax has $10,000 in stock that she wishes to donate to the charity of her choosing. The initial cost basis of the securities is $1,000. If she first sells the stock and then donates the proceeds to charity, she would be able to donate $8,200 after she paid $1,800 in long-term capital gains taxes on the sale. If she instead donates the stock directly to charity, she can donate the entire $10,000 and avoid paying capital gains taxes on that stock. (For simplicity, this example only considers Federal tax savings.) Not only is she able to donate more to charity via a direct stock contribution, but she is also able to avoid some capital gains tax as well as potentially deduct her charitable giving from her income taxes. While the actual benefit would vary depending on the initial cost and appreciation of the stock as well as the donor’s tax situation, there is significant potential for tax savings as well as increased giving capacity.

If you have assets like stocks that have significantly appreciated in value, donating those assets may be very beneficial both to you and to the charity recipient. This may be particularly true if your overall portfolio is overweight such highly appreciated assets.

How To Give It

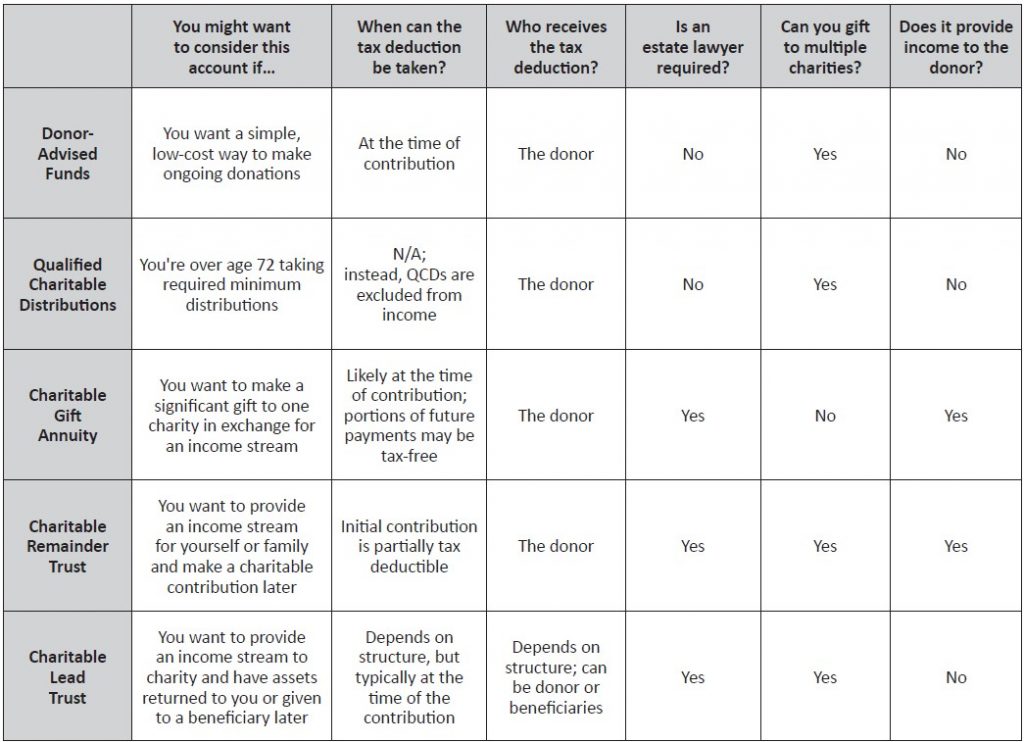

Those who want to put aside a significant amount of money for current and potentially future giving or to include a charity in their estate plans have a variety of options for meeting their charitable goals. Below, we provide a summary of some of the most common giving vehicles and their uses in chart form, and then discuss these giving options in greater detail.

Donor-Advised Funds

Donor-advised funds are a simple, tax-efficient option for charitable giving, and are the most accessible giving vehicle on this list. Anyone can open a fund with an initial contribution of as little as $5,000 and assets in the fund are professionally managed and invested for future growth. The donor receives a tax deduction at the time of the contribution to the fund rather than when assets are distributed to a charity out of the fund. Once the fund has been established, the donor can make contributions to any registered charity out of the fund at any time.

Importantly, donor-advised funds can accept gifts of securities or other non-cash assets. While all nonprofits can accept donations of stock or real estate in theory, smaller nonprofits may not have the necessary administrative capability to accept non-cash gifts in practice. A donor-advised fund removes the need for the nonprofit to be able to accept a non-cash gift, as a contribution of stock could be made first to the fund and then paid out in cash to the nonprofit. This provides the donor with all of the benefits of giving appreciated assets without limiting the number of charities he or she can support.

For more detailed information on donor-advised funds, read our prior Navigator on the topic.

Qualified Charitable Distributions

Retirees who are taking required minimum distributions (RMDs) from their qualified retirement accounts have access to a particularly tax-beneficial giving option: qualified charitable distributions (QCDs). RMD recipients are able to donate some or all of their RMD directly from their IRAs or qualified accounts to the charity of their choice. This donation will count towards the RMD requirement but is excluded from income for tax purposes. This is one important difference between a normal donation and a QCD: charitable giving is typically counted as a deduction against income, but QCDs are actually excluded from income. Given a choice between using a donor-advised fund or a QCD to give, a retiree will likely receive more tax benefit by making a donation directly from his or her IRA.

Charitable Gift Annuity

A charitable gift annuity is a giving option for a donor who can make a sizable up-front donation to a single charity. Essentially, this type of annuity is a contract between the donor and the charity: the donor makes a large gift, and in return is eligible for a partial tax deduction and a fixed income stream from the charity for the rest of his or her life. The charity sets the donation aside in a reserve account and invests it. At the end of the donor’s life, the charity receives whatever is left of the invested funds.

The particular details of these annuities will depend largely on the individual organizations writing the contracts, but generally speaking, donors (or a donor and the donor’s spouse) will receive fixed monthly or quarterly payouts for life at a rate based upon the age of the donor when the gift is made. The annuity can often be funded by gifts of securities and personal property in addition to cash. Minimum gifts for establishing a charitable gift annuity can be as low as $5,000 but are likely to be much larger.

Those forming a charitable gift annuity may be eligible to take a tax deduction when the annuity is formed. The amount that will be deducted from the current year tax return will vary, as it is determined based on the estimated amount of the annuity that will eventually go to the charity. In addition, a portion of the payments you will receive in the future may also be treated as tax-free, depending on life expectancy. Depending on the individual charity, it is possible that a donor would be able to contribute appreciated assets to the annuity rather than cash, allowing him or her to take advantage of reduced or eliminated capital gains taxes on those assets.

Charitable gift annuities can only be formed with one nonprofit, so a single annuity can only support one organization. Additionally, not all nonprofits are able to provide charitable gift annuities. Generally, only very large nonprofits like universities can enter into this type of giving arrangement.

Forming a charitable gift annuity means permanently giving funds to the nonprofit of your choosing, so potential donors must be comfortable with exchanging those portfolio assets for the income stream. In addition, the payments are made at a fixed rate that will not adjust for inflation, and that rate may be lower than what you could receive in a non-charitable annuity because the funds will be used for nonprofit support.

Charitable Remainder Trust

A charitable remainder trust (CRT) is an irrevocable trust that provides an income stream for the donor and/or other beneficiaries and then passes the remaining assets in the trust to one or more charities at the end of its term. CRTs can be structured to provide annual income over the life of the donor or a beneficiary, and then pass remaining assets to charity.

There are two main types of charitable remainder trusts: charitable remainder annuity trusts (CRATs), which distribute a fixed annuity amount each year with no additional contributions allowed, and charitable remainder unitrusts (CRUTs), which distribute a fixed percentage of trust assets annually and can accept additional contributions. In both cases, the trust must distribute at least 5% but no more than 50% of its assets each year to the owner or beneficiaries.

When creating a CRT, the initial contribution is partially tax deductible based on the type of trust, the term, the projected income, and assumed growth rates. Donors can fund a CRT with cash, stocks, or even non-publicly traded assets, allowing them to take advantage of contributing appreciated assets if they choose. CRTs can be created during the donor’s life, in which case he or she will receive a current income tax and gift tax charitable deduction for the present value of the remainder interest. If created after death, the donor receives an estate tax charitable deduction.

It is also possible to combine a CRT with a donor-advised fund by making the trust beneficiary the public charity that sponsors your donor-advised fund. Using this strategy, you would give yourself greater flexibility in how you distribute the funds to charity in the future. Amending the charitable beneficiary of a charitable trust can be complicated if even allowed, whereas using the donor advised fund as the beneficiary allows you flexibility in your giving.

Charitable Lead Trust

A charitable lead trust (CLT) is a way for a donor to provide an income stream to one or more charities for the duration of the trust. It stands in polar opposition to the CRT: the charity receives the income stream and non-charitable beneficiaries receive the remaining assets at the end of the trust term. The donor makes a gift of cash or other assets to an irrevocable trust, which provides an income stream to the charity until the specified trust term ends. At that point, the remaining assets are distributed to non-charitable beneficiaries.

There are two basic types of CLTs: grantor CLTs and non-grantor CLTs. In the grantor CLT structure, the donor is considered to be the owner of the trust for taxation purposes and receives the trust assets back at the end of the trust term. In this case, the donor gets an immediate tax deduction on the charitable contribution, but then pays taxes on the CLT income (including payouts to charity). In a non-grantor CLT, the trust is considered the owner of the assets, so the donor does not receive an income tax deduction. The trust pays the taxes and claims charitable deductions on its distributions. Depending on the structure of the non-grantor CLT, this type can be used to reduce gift or estate tax obligations on the assets, which can offer greater benefits for assets being transferred to other beneficiaries.

If the CLT is funded with cash, the donor can receive a charitable deduction of up to 60% of Adjusted Gross Income (AGI). If instead appreciated assets are used, up to 30% of AGI may be deducted. However, if the donor can’t use the entirety of the deduction in the year of the gift, it can be carried forward for up to five years.

Estate Planning Options

Many of the trusts described above are also appropriate vehicles for your estate plan. Both charitable lead trusts and charitable remainder trusts in certain configurations can pass assets to charity and to your heirs in tax-efficient ways. They can often be set up in life or at death and can be used to remove assets from your estate, create a tax deduction for charitable giving, and/or provide a steady income stream for loved ones.

Another option to consider in estate planning is to make a charity the direct beneficiary of your IRA or other qualified retirement account. The charity will not be taxed on distributions from the IRA, maximizing the benefit of those distributions. The value of the IRA would be included in your gross estate, but your estate would receive a tax deduction for the charitable contribution.

In a recent Navigator, we discussed how charitable remainder trusts and leaving IRAs directly to charity can have additional estate planning benefits if you are the owner of a large IRA that you wish to pass to someone other than your spouse.

If you are considering a new charitable giving strategy, we would suggest that you have a conversation with your tax professional and estate lawyer, as some can have significant implications for taxes and your estate. Not all giving strategies will be appropriate for everyone, so it’s important to ensure you are making the right choice for yourself, your heirs, and your favorite charities. The list above is not comprehensive, but it hopefully provides a sense of the many vehicles and strategies that donors have available to them to maximize the benefit of their giving. If you want to rethink your charitable giving, we encourage you to reach out to your portfolio manager to discuss which may be the best option for you.

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only and is not intended as an offer or solicitation for business. The information and data in this article does not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Pekin Hardy cannot assure that the strategies discussed herein will outperform any other strategy in the future, there are no assurances that any predicted results will actually occur.