“Most of the recent rise in inflation appears likely to be transitory,

and FOMC [Federal Open Market Committee] participants

expected inflation to subside in coming quarters

to rates at or below the level of two percent or a bit less.”

─ Ben Bernanke, former Federal Reserve Chairman,

Congressional testimony, July 13, 2011.

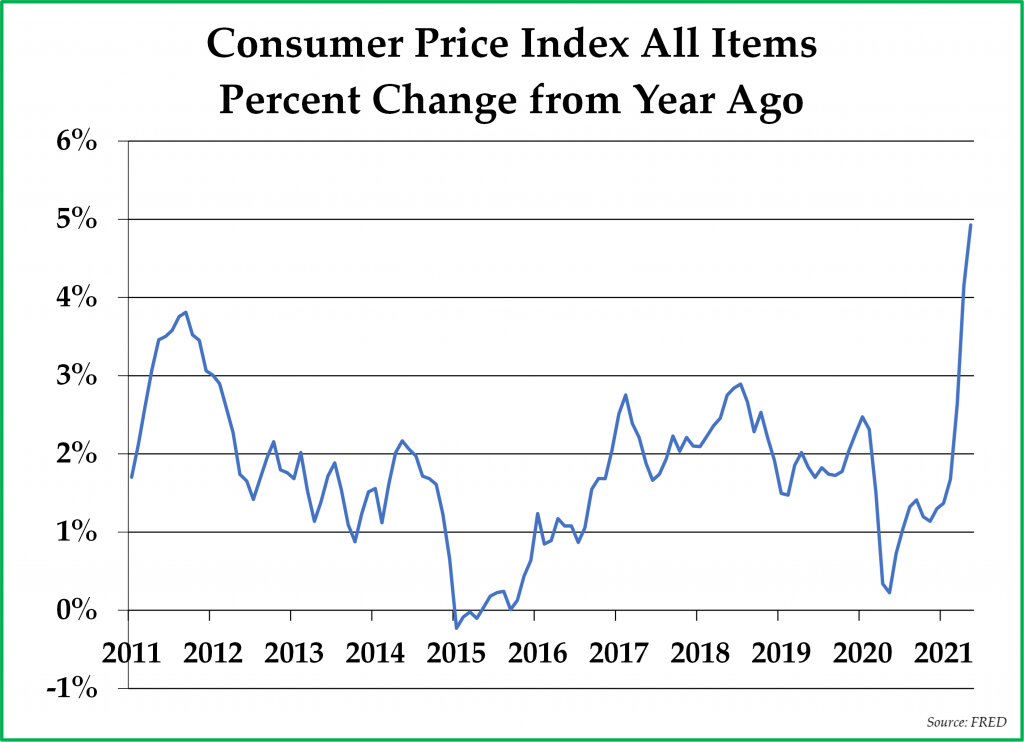

In July 2011, when Chairman Ben Bernanke provided this testimony to Congress, accelerating inflation was on everyone’s minds. Oil prices had risen to above $110 per barrel during the first half of the year, and the cost of filling up a car tank with gasoline had doubled from what it had been just two years earlier. Food prices were rising sharply and served as a catalyst for a series of revolutions across the Middle East, now known as the Arab Spring. The year-over-year increase in the consumer price index (“CPI”) reached as high as 3.9%, which was well above the Federal Reserve’s long-term inflation target of 2% per year. The inflation worries of both investors and consumers were driven by the increase in prices and the Federal Reserve’s ongoing purchases of U.S. Treasuries and mortgage-backed securities, which many (including ourselves) perceived to be inflationary.

Today, oil prices are rising again along with food prices, and the year-over-year increase in the CPI reached 5.0% in May, while the producer price (“PPI”) index increase was 6.6%. With this most recent inflation data, Federal Reserve Chairman Jay Powell finally acknowledged that the current inflationary impulse has been stronger than the Fed had previously expected while, at the same time, continuing to insist that it is transitory.

In retrospect, Chairman Bernanke’s 2011 call for inflation to be transitory was absolutely correct. Between 2012 and 2016, the year-over-year increase in consumer prices ranged from 0% to 2%. Will Chairman Powell, describing today’s inflation impulse as transitory, also turn out to be correct?

Inflation: Transitory or Longer-Lasting?

The arguments for inflation being transitory seem reasonable enough. First, today’s excessive debt levels are inherently deflationary as cash flows must be diverted from investment and consumption, which drive economic growth, towards servicing debts. Second, the current inflationary impulse could be driven by temporary pandemic-related supply chain breakdowns that may soon be fixed. Third, the Federal Reserve is once again using the same monetary stimulus playbook (buying U.S. Treasuries and agency mortgages) that turned out to produce transitory inflation in 2011. Fourth, the economy should continue to benefit from technological innovation, which is inherently deflationary. These are reasonable points, but our view is that the inflationary forces should continue to outweigh these factors.

One of the difficulties with the debate about whether inflation is transitory is that the time frame in question generally remains undefined: how long would “transitory” inflation last? We agree that the CPI may be peaking for this year; however, we expect the inflation rate as measured by the CPI in the second half of the year to remain persistently above 4%. While acknowledging that the CPI will fluctuate in the short-term depending on the business cycle, fiscal spending, and currency exchange rates, we would argue that inflation should remain above 3% on average over the next five years. Despite the disinflationary arguments mentioned above, we expect inflation to persist over the intermediate-term for the following reasons:

-

-

-

- Excessive levels of debt

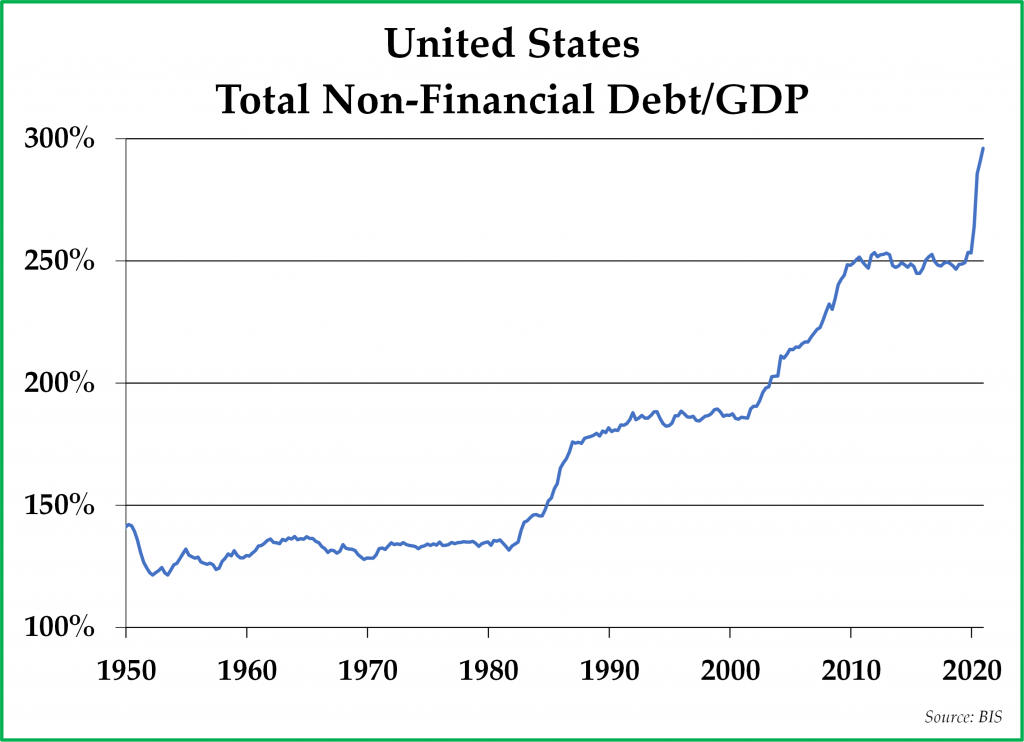

Between government debt, corporate debt, and consumer debt, the United States is more indebted today than it has ever been historically, with a total non-financial Debt/GDP ratio of nearly 300%. This excessive debt is a financial time bomb that, left to its own devices, could result in a deflationary bust involving widespread defaults, stock market and housing market crashes, and bank failures. As a result of this genuine and worrisome threat, policymakers are not leaving anything to chance. It has become increasingly clear that a high level of inflation is becoming a policy goal to alleviate indebtedness and the risk of deflationary bust that comes with excessive debt. In our view, this was the policy goal in 2011, too, only policymakers failed at their goal, for reasons that we will explain. The U.S. Debt/GDP ratio has not fallen but has, in fact, risen by about 50% of GDP since then. Today’s excessive level of debt, then, is not a driver of inflation per se; however, it is a driver of the government policies that cause inflation.

–

–

– - Record fiscal deficit spending combined with record monetary stimulus

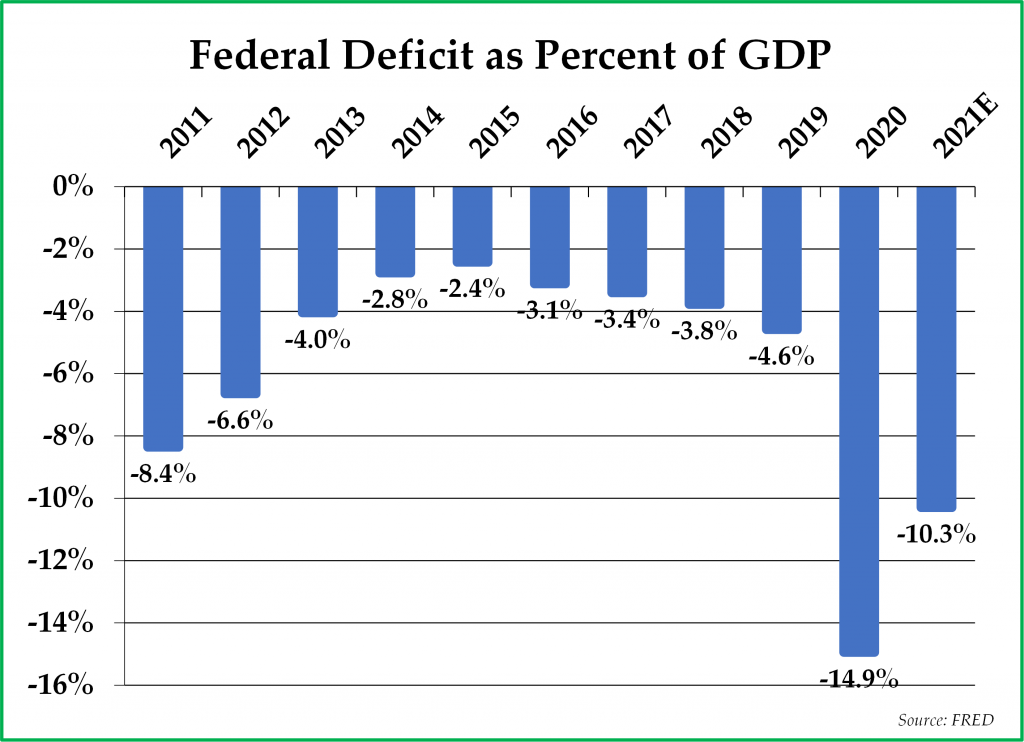

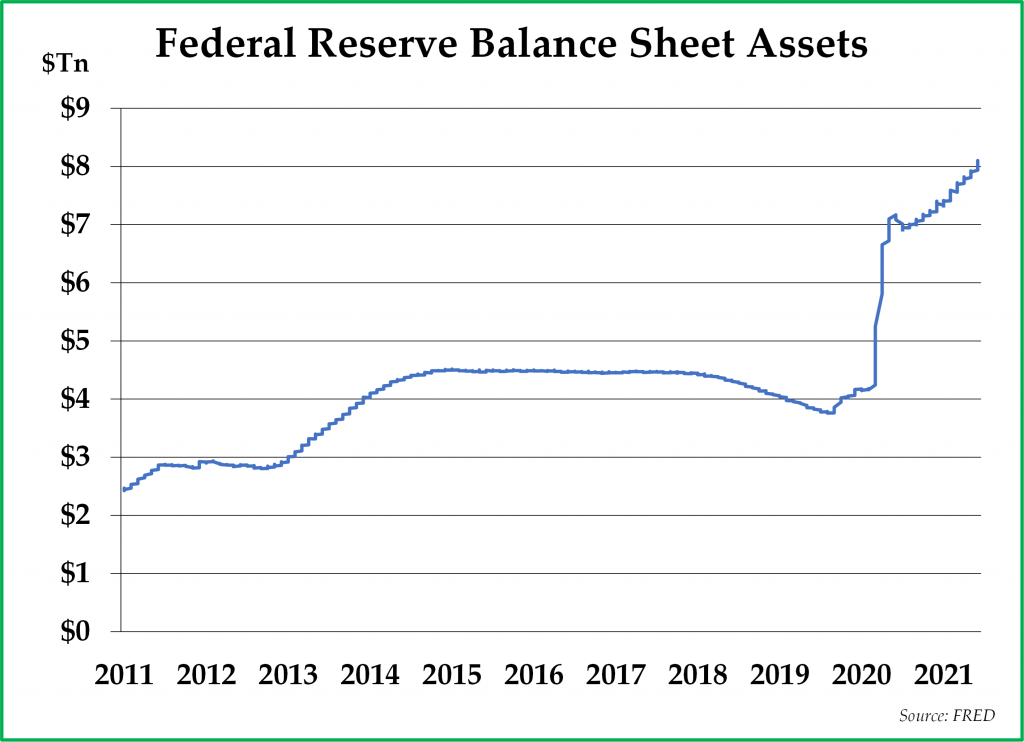

With serial trillion-dollar-plus stimulus packages starting in the spring of 2020, financed with monthly Treasury bond purchases by the Federal Reserve, the U.S. government and Federal Reserve are, in effect, cooperating to print money and distribute it to consumers to spend in the economy. This is a perfect example of the “helicopter drops” of money famously described by Ben Bernanke in the 2002 anti-deflation speech that earned him his job as Chairman of the Federal Reserve several years later: In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities. A broad-based tax cut [not just for the wealthy], for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices. The U.S. fiscal deficit represented 14.9% of GDP in 2020 and is projected by the CBO to be 10.3% of GDP in 2021, while the Federal Reserve has financed this spending with the purchase of over $4 trillion of U.S. Treasury bonds and other financial assets since March 2020:

–

These gargantuan stimuli have been accompanied by the increasing popularity of Modern Monetary Theory among economists, which argues that the only limit to fiscal spending is excessive inflation. With inflation being the only limitation on deficit spending, it might be no wonder, then, that policymakers are describing the current inflationary impulse as transitory.

–– - Deglobalization

The modern age of globalization began during the Clinton administration with the passage of NAFTA and accelerated during the Bush administration with China joining the World Trade Organization. Free trade policy benefited certain interests, such as multinational corporations, and hurt other interests, such as U.S. manufacturing workers. Free trade also benefited consumers, as the price of imported goods manufactured in countries with cheap currencies and low wages kept price inflation in check.However, beginning with the Trump administration and continuing with the Biden administration, trade policy is in the midst of a significant paradigm shift. Tariffs and other trade barriers have been erected to protect domestic producers. Companies are reshoring global supply chains, which have shown themselves to be less than completely resilient during the pandemic. The United States is treating more product categories as strategic, from face masks to pharmaceuticals to semiconductors, and is working to bring the manufacturing of such products back to the United States. Finally, China, the biggest exporter to the world, is increasingly perceived by the developed world as an adversary rather than a trading partner. Just as the globalization of supply chains has been disinflationary due to a decline in labor input costs over the past two decades, the deglobalization of supply chains should prove to be inflationary as labor input costs increase.

– - Rising energy prices

There is a popular expression among commodity investors that the cure for low prices is low prices, and, conversely, the cure for high prices is high prices. In 2008, the world experienced record-high oil prices, and the profits of the energy industry expanded greatly. With rising profits came an extraordinary level of investment into future oil production. The resulting shale oil boom of the 2010s and a rapid increase in global oil production dampened energy prices. In 2020, record low oil prices led to record losses among energy companies and significantly reduced capital expenditures in energy exploration projects. Due to lack of investment and fewer new discoveries, supply growth across the world will be limited and outright supply declines wouldn’t be terribly surprising. Although supply will likely be tight, given aggressive policymaker plans to invest in infrastructure, we expect demand for oil and other commodities to remain robust, even with considerable electrification market share gains within the transportation industry. With constrained supply and increasing demand, energy prices should continue to rise in the coming years, putting upward pressure on costs across a wide range of goods and services.

– - Increasing wages

Baby boomers are retiring in droves, and they are not being replaced by enough Generation Z workers entering the workforce. As the U.S. population ages and an increasing proportion of the workforce retires, companies are likely going to be hard-pressed to find new workers. According to Oxford Economics, an estimated two million workers have retired since the beginning of the pandemic, representing a retirement rate that is roughly double that of 2019. At the same time, minimum wage thresholds have been increasing, along with unemployment benefits. We would not be surprised to see an increase in the power of private-sector unions for the first time in a generation. All of these trends should lead to higher wages for the U.S. workforce.

– - Dollar Depreciation

Until 2014, foreign central banks sterilized U.S. deficits by taking the dollars they earned from exporting goods to the United States and reinvesting them into U.S. Treasuries. These Treasury bond investments supported the U.S. dollar’s value and kept the currencies of net exporters from rising in value. With a U.S. trade deficit currently running at 3.9% of GDP and a Federal deficit running at 10.3% of GDP, the dollar is being held up by foreign capital investment flows into U.S. real estate and the U.S. stock market. Meanwhile, most of the new U.S. Treasury bonds that are issued are being purchased by the Federal Reserve. We believe all of this is a setup for the dollar to drop in value against the currencies of net exporters when foreign investors sour on U.S. investments. If (or when) interest rates begin to rise and the Federal Reserve intervenes to prevent Treasury interest rates from rising, the dollar’s depreciation should accelerate, resulting in higher prices for imported goods and services.

- Excessive levels of debt

-

2011 Again, or Something Different?

The circumstances today, which cause us to suggest that inflation will not be transitory, are quite different from the circumstances of 2011, when inflation did turn out to be transitory. In 2011, the U.S. fiscal deficit was manageable, and the monetary stimulus from quantitative easing was less than 25% of what it has been thus far in 2021. In 2011, globalization was expanding, not contracting, and the central banks of net exporters were still recycling the dollars they earned from their surplus into U.S. Treasuries. The shale oil boom in the United States was just beginning, leading to a flood of new supply along with lower energy prices and a reduced U.S. trade deficit. Importantly, because the U.S. trade deficit declined, the dollar strengthened, which was disinflationary. These factors prevented inflation from taking root in 2011, which is why we suggested earlier that policymakers who wanted inflation in 2011 due to an excessive debt to GDP ratio failed to achieve their policy goals. These factors also lead us to conclude that this time in 2021 is quite different from the transitory inflation of 2011.Of course, on a long enough time horizon, this inflation, too, will cease. There will come a time again when a bold central banker like former Chairman Paul Volcker raises interest rates to put a stop to inflation. There will also come a time when Congress decides it is time for fiscal discipline and reduced deficits. If these things happen 20 years from now, does that mean our inflation is transitory? The time for fiscal and monetary discipline is far into the future, in our view, because the debt burden that has not yet been inflated away remains far too large relative to the size of the economy. And the best way to enlarge that economy is to allow for wages and prices to rise.

Our asset class preferences remain unchanged. We like investments such as precious metals and equities that have historically demonstrated an ability to keep up with inflation. Such equities include companies with high fixed costs and low variable costs and companies with the power to raise prices in an inflationary environment. We are shying away from investments like corporate bonds that are likely going to struggle to keep up with inflation.

*****

We want to express once again our appreciation for the trust you have placed in us to manage your investment portfolio during these remarkable times. We hope you have a fantastic summer.

Sincerely,

Pekin Hardy Strauss Wealth Management

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Past performance is no guarantee of future results. The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics.

-