The cost of long-term care has risen materially over the past few decades, creating financial hardship for millions of aging Americans and their families. As the cost of care continues to increase, so too does the need for a sound strategy for managing these potential costs. Purchasing long-term care insurance is one such strategy. This article discusses the structure of long-term care insurance, its advantages and drawbacks, and some key points to consider when deciding if long-term care insurance should be a part of your broader financial plan. In addition, we examine some alternative methods of managing this potential risk.

Long-term care (LTC) refers to the assistance that people with disabilities, chronic illnesses, or other conditions require on a daily basis. It can include various types of care, ranging from part-time in-home assistance to full-time round-the-clock residential nursing home care. Patients may pursue such care for a variety of reasons, including both physical and cognitive infirmities. LTC contrasts from other types of medical care in that the goal is not necessarily to cure an illness or medical condition but, rather, to help one meet their medical and non-medical needs when self-care is impossible. Caregivers help patients with routine daily activities, such as eating, dressing, bathing, health care, and many other day-to-day activities.

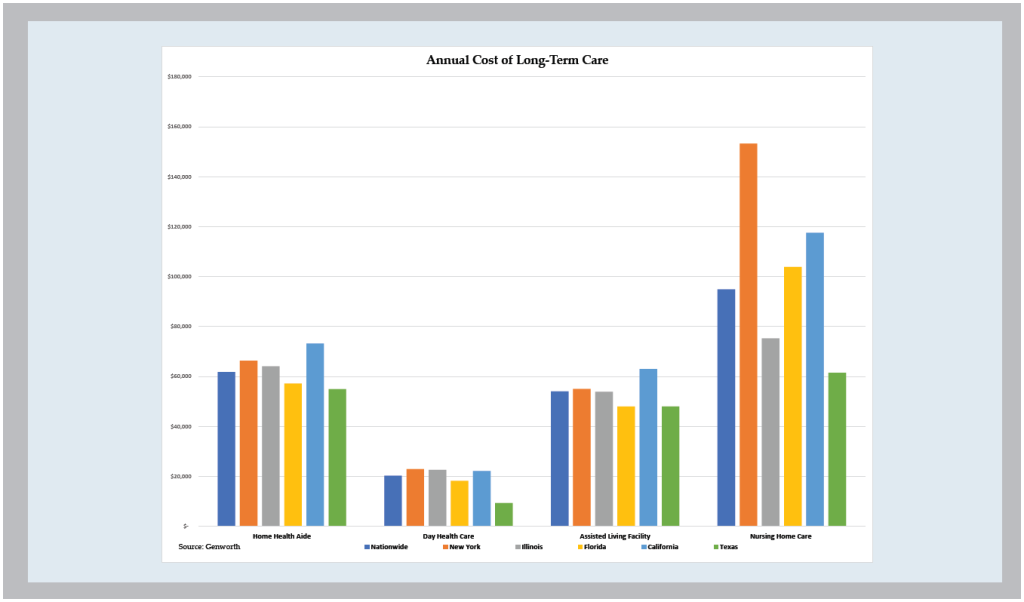

Approximately 68% of all Americans who reach age 65 will need some sort of LTC during their lives. At an average nationwide rate of ~$200 per day, LTC costs can add up to rather daunting sums of money quite quickly, creating a grave financial burden that many people are ill-prepared to bear1. Many Americans incorrectly believe that Medicare covers LTC and therefore fail to properly prepare for the eventual costs associated with such care. While Medicaid does cover some LTC costs for the poor, Medicare has no such provisions, leaving middle and upper-class Americans to fend for themselves when it comes to covering these costs.

This backdrop certainly argues for a modicum of planning with regard to the potential for needing LTC, and purchasing LTC insurance coverage is one possible method of mitigating this risk. However, making an educated decision on whether or not to purchase such coverage requires a thorough understanding of the nature of long-term care insurance; beyond that, the type and scope of such LTC insurance also require significant analysis. The purpose of this Navigator is to explain how LTC insurance works, the pros and cons of LTC insurance, and how this type of insurance may or may not fit into your broader financial plan.

As previously mentioned, LTC can be expensive, indeed prohibitively so for some. An extended stay in a residential facility (or extensive use of skilled care in any setting) can quickly erode a patient’s investable assets. Enter long-term care (LTC) insurance. Most of us have heard the term, but what is long-term care insurance, exactly? It is a specific type of insurance contract that is designed to protect against the risk of financial hardship due to an extended need for skilled medical or assisted living care. While these policies come in all shapes and sizes and include a variety of coverages, they are all designed to help ease the financial impact that extended LTC may impose on a policyholder.

The Structure of Long-Term Care Insurance

Like substantially all other types of insurance products, LTC insurance policies can be customized to fit practically any situation, and, therefore, no two policies are exactly alike. However, in almost all cases, LTC insurance policies are likely to include four primary elements that can then be adjusted to fit the policyholder’s specific needs:

- Maximum Monetary Benefit

The maximum monetary benefit is the amount that the policy will pay for LTC, and it is generally quoted as a daily rate (typically between $100 and $500 per day). If approved by the LTC insurance carrier, the policyholder can expect to receive up to this amount per day for care received. Charges incurred beyond this daily amount would be the responsibility of the policyholder. In most cases, once benefits commence, premiums cease. If the policyholder subsequently leaves LTC treatment, then premiums resume.

– - Maximum Life of a Policy

The maximum life of a policy is the period over which the policy will pay the stated daily coverage rate. The time period for most policies ranges from one to five years. However, while the maximum life of the policy may be stated in years, the total dollar amount is what really matters. For example, a policy with a maximum life of three years and a maximum monetary benefit of $250 per day will cover a total of $273,750 in long-term care costs2. In reality, a policyholder is buying a total pool of benefits that can be used over a certain period of time. - Elimination Period

The elimination period refers to the period of time between when a policyholder files for LTC benefits and when the policy actually begins paying those benefits. This period essentially serves as the de facto deductible for a long-term care policy, and it can range from zero to 365 days. The most common elimination period in LTC insurance policies is 90 days, meaning that a policyholder would have to wait 90 days from the time that he or she qualified for benefits to when the policy would begin disbursing benefits. - Inflation Adjustment

As the name implies, inflation adjustments increase the total benefit pool to which a policyholder is entitled over time in order to ensure that benefits keep up with increases in the cost of care due to inflation. This component plays a critical role in any LTC insurance policy. Assuming that future inflation is in line with historical levels (roughly 3% annually) and LTC costs increase with broader inflation, a person who enters LTC twenty-five years from now will pay more than twice as much as she would pay for the same care today. However, it is important to note that adding options such as inflation adjustment to a policy can materially increase the cost of the policy, possibly by 50% or more.

The purpose of these policies is to provide the policyholder with benefits in case LTC is needed, and most LTC insurance policies serve this purpose well. However, it is important to fully understand the primary benefits and drawbacks of LTC insurance, as well as alternative methods of managing this risk, before determining if LTC insurance is right for you.

The Pros and Cons of LTC Insurance Coverage

The list of reasons to purchase LTC insurance is quite short. There is really only one argument that can be made in favor of purchasing coverage, but it is both obvious and compelling: LTC insurance can prevent you and/or your family from being financially devastated by the costs associated with an extended stay in an LTC facility. As LTC costs continue to climb, having appropriate coverage that should help to significantly offset these costs will undoubtedly give you peace of mind, knowing that you and/or your family will be largely free of the potentially devastating financial burden of paying for extended LTC, should you ever need it.

Conversely, there is more than one argument against purchasing LTC coverage, and they, too, are quite compelling:

- The Cost for LTC insurance can be prohibitive.

LTC insurance policies typically have painfully steep premiums, and these premiums continue to rise for both new and existing policyholders. - LTC insurance benefits may be denied, regardless of need.

Many LTC policies have very strict eligibility requirements that must be met in order to pay benefits. If you do not meet these requirements, you may incur LTC expenses without ever receiving benefits to which you thought you were entitled. - You may never need LTC.

There is a reasonable probability that you will never need LTC. If you never incur any LTC expenses, then you will have paid a substantial amount of money into a policy from which you will never receive any benefits. Of course, there is some value to the peace of mind that you may have generated by having LTC insurance. - Many LTC insurance providers are seeing their business models under assault.

One of the largest remaining suppliers of LTC insurance, Genworth, is experiencing significant operational difficulties that may be emblematic of the industry. Their profitability is getting squeezed from increased LTC claims as compared to the cash flows coming in from premiums. This trend magnifies the fact that potential price increases are around the bend for existing LTC insurance policies.

Of the negatives listed above, the most relevant issue is the cost of coverage. Over the past several years, more than half of the 20 largest LTC insurers have ceased selling new LTC policies, and holders of in-force policies have seen their premiums spike as a result of insurers’ inability to properly price LTC insurance policies. Companies that are no longer issuing new policies are still required to honor existing policies, but, in most cases, they have been able to raise premiums (with the approval of state insurance regulators), often by substantial amounts and in many cases, multiple times. In recent years, many holders of in-force LTC insurance policies have seen their premiums rise by more than 50%, and policyholders would be wise to anticipate further premium increases in the future.3

Growing numbers of seniors, rapidly rising healthcare costs, and an extended period of low-interest rates have made it increasingly difficult for insurers to cover the costs of existing LTC insurance policies without hiking premiums for both new and existing policyholders. This trend of rising LTC insurance prices is unlikely to reverse in the foreseeable future because the drivers of the cost increases are not transient in nature. Therefore, the peace of mind provided by LTC insurance coverage is offset by high-cost premiums that are likely to only go higher in the coming years.

While cost is far and away the most significant drawback with regard to long-term care insurance, consumers would be remiss not to fully consider the other drawbacks of LTC insurance. One can imagine the frustration that would result from paying premiums for years to ensure LTC benefits, only to be denied those benefits when they ultimately are needed. Such cases are not uncommon. There have been a number of well-publicized cases in recent years of insurance companies denying LTC coverage to policyholders who had faithfully paid premiums for many years because the policyholder did not meet the insurance company’s unique requirements for making claims4. In many cases, the insurance company makes its own determination (rather than a treating physician) of a policyholder’s eligibility for benefits, leaving the door open for denial of those benefits.

While LTC expenses can no doubt wreak havoc on a person’s finances, statistics indicate that the probability of incurring such devastating costs is surprisingly low. It is estimated that only 5% of people who reach age 65 will ever incur $250,000 or more in long-term care costs over their lifetimes. Most people who do wind up needing LTC end up spending far less than this figure, making the protections offered by LTC insurance materially less valuable. And, of course, a significant percentage of Americans will never need LTC at all. One salient statistic worth noting s that nearly 70% of all seniors who go into a nursing home are discharged within 90 days. Given that the majority of LTC insurance policies have a 90-day elimination period, it is likely that a policyholder who does require LTC may not be eligible to receive such benefits.

Is LTC Insurance Right for You?

In the final analysis, given the benefits and drawbacks, the question remains: who should consider purchasing long-term care insurance? The answer to this question is, of course, unique to each person’s specific situation. There is no “one-size-fits-all” answer for everyone. However, there are several factors that people should consider when deciding whether or not LTC insurance is right for them:

- Size of Asset Base

The first factor to consider is the size of your asset base. If you have a substantial amount of assets, you can “self-insure” against the possibility of needing LTC; self-insurance means that you can pay for these costs out of your own assets if indeed it becomes necessary to do so. At the same time, if you do not end up needing LTC, your assets remain your own rather than having been whittled away by expensive insurance premiums. In general, people with $1 million or more in assets should probably consider this “self-insurance” option, though it may also be optimal for people with smaller asset bases as well, depending upon other factors.The clear benefit of this alternative to LTC is that you will not waste any money on premiums should you never incur any LTC costs. If you never need to pay for LTC, you can use these assets for other purposes or as a lasting legacy for your heirs. Another benefit is that the growth of your assets over time could be significant as a result of having the freedom to invest the assets as you see fit instead of locking them into a very expensive, multi-year insurance policy with potentially rising premiums. The self-insurance option is obviously most suitable for investors with substantial asset bases, though other factors (such as family situation) may also make this the optimal strategy for investors with a more modest amount of assets.

– - Family Situation

Another factor that is key in deciding whether or not to purchase LTC insurance is your family situation. Do you have family members who are likely to be dependent upon your assets? Do you wish to leave a legacy for your children or grandchildren? Do you have children that have the willingness and ability to provide care for you in the event that you need it? Are you comfortable relying on them for such care? These are all questions that should be considered by anyone who is contemplating purchasing LTC insurance. If you have family members who will be reliant on your assets in the future or you are planning to provide for a grandchild’s education (for example), you must consider the fact that a protracted stay in a long-term care facility could potentially wipe away the assets upon which your family will rely. On the other hand, depending on the situation, family assistance may be a viable alternative to a nursing home or assisted living facility that would allow you to potentially hold onto the majority of your assets.The benefits of family assistance are the obviously lower financial cost, as well as the fact that you may be able to remain in your own home instead of living in a nursing home or assisted living facility. This is not a viable option for everyone, but it may be worth having an honest discussion with your family well ahead of time to determine whether or not this may be an alternative means of managing your LTC risk. - Health History

As you contemplate the possible purchase of LTC insurance, another important consideration that should be a part of your decision-making process is health history – both your own and that of your family. If you have a history of health issues that could indicate a higher probability of ultimately needing long-term care, then clearly you should factor this into your calculations when deciding whether or not to purchase a long-term care policy. Similarly, if your family has a history of Alzheimer’s Disease or other genetically-linked maladies that may require long-term care, then you should factor this in as well. An increased probability of needing LTC significantly increases the value of an LTC insurance policy, so personal and family health histories should be carefully considered when deciding how to manage LTC risk. However, it is important to note that insurance companies have recently started to factor family health history into their underwriting processes as well, so policyholders whose family histories indicate elevated risk are likely to see this reflected in the premiums that they pay.

– - Age

There can be significant variations in the cost of long-term care insurance by age. A 70-year-old person who wishes to obtain LTC insurance is likely to face a far greater premium cost than a 50-year-old who wishes to obtain the same coverage. This is because the risk associated with an older policyholder is, on average, materially greater than that associated with a younger policyholder. So, if your personal situation puts you at significant risk for needing long-term care and you are concerned about your ability to fund these potential costs, you may be wondering when to buy long-term care insurance. In these circumstances, the answer is, “As soon as possible,” as costs are likely to only go up as you age.We could not possibly list all of the factors that should be considered with respect to making a decision about LTC insurance, as each person’s situation is unique. However, those factors discussed above should help to get you started as you work through the process of deciding whether or not LTC insurance makes sense for you. Again, this decision is different for everyone, and our goal is simply to provide you with the most important information that should be considered when making this decision.

Conclusion

In conclusion, developing a strategy for managing the risks associated with LTC costs can be a complex and daunting task. There is a myriad of factors to consider when deciding how best to protect your assets against the potential costs of LTC, and there are many different long-term care insurance options from which to choose. However, it is our hope that the information provided in this analysis will help to guide your thinking as you work through the process of determining whether LTC insurance makes sense as a part of your broader financial plan. We understand the individual nature of this particular decision and all of the complexities that surround it, and we are here to help you navigate through this process in any way that we can.

1 Figures taken from Genworth.com

2 Three years x $250/day x 365 days/year = $273,750.

3 Figures taken from spglobal.com.

4 Figures taken from nytimes.com.

The commentary in this video and article was prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only (and is not intended as an offer or solicitation for the purchase or sale of any security.) The information and data in this article and video do not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report and video, and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of individual holdings, market sectors or any particular strategy, there is no guarantee that the strategies discussed herein will outperform any other. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur.