Maximizing Retirement Savings: How the Super Catch-Up Contribution Can Help You

Saving and investing your money is always imperative for financial security. As you approach retirement and hit the quarter century mark, there are additional savings benefits for your retirement accounts that should be utilized. The traditional catch-up contribution was introduced in 2001 and is a powerful piece of legislation allowing individuals aged 50 and above to save more in certain retirement accounts and qualified plans. In 2022, the SECURE 2.0 act was introduced and has been gradually implemented into the saving and investment environment. One of the benefits of this act is the super catch-up contribution.

Here’s what you need to know about this enhanced opportunity and how to take advantage of it.

What is the Super Catch-Up Contribution?

The Super Catch-Up Contribution is an expanded provision in the SECURE Act 2.0 that allows individuals nearing retirement to contribute significantly more to their accounts. It builds on the traditional catch-up contribution already available to those aged 50 and older. The exact contribution limits for the Super Catch-Up Contribution are indexed for inflation and may vary annually. Here’s an example to illustrate how it works for 2025:

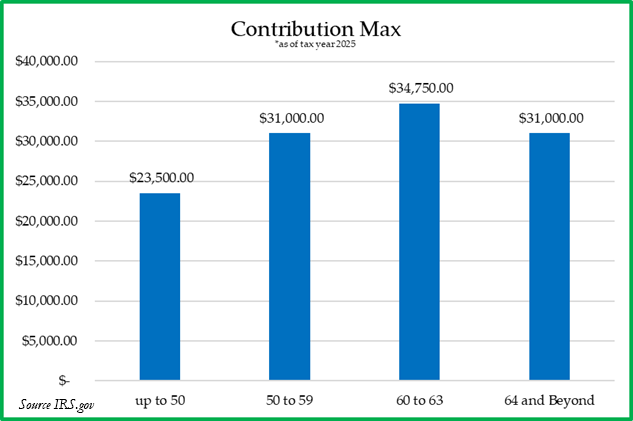

- Retirement Contribution Limits: 401(k), 403(b), 457 and Government Thrift Savings Plan contribution limit is $23,500 and the IRA limit is $7,000 for 20251.

- Traditional Catch-Up Contribution: As of 2025, individuals aged 50 and older can contribute an additional $7,500 to their 401(k), 403(b), and similar employer-sponsored plans, or an additional $1,000 to their IRAs.

- Super Catch-Up Contribution: For those aged 60-63, the contribution limits increase further. Individuals in this age range can contribute up to an additional $11,250 into their 401(k), 403(b), 457 and Federal Thrift Savings Plan for a total contribution of $34,750.

Who Qualifies for the Super Catch-Up?

The Super Catch-Up Contribution is specifically designed for individuals aged 60, 61, 62, and 63 during the tax year. If you fall within this age range, you’re eligible to contribute beyond the standard catch-up amounts.

This expanded contribution window acknowledges that many people prioritize retirement savings later in their careers and provides an opportunity to accelerate savings during the final stretch before retirement.

Benefits of the Super Catch-Up Contribution

- Boost Retirement Savings

The Super Catch-Up Contribution provides an opportunity to significantly increase your retirement nest egg, helping you close any savings gaps and achieve your retirement goals. - Tax Advantages

Contributions to a traditional 401(k) or IRA are typically tax-deferred, reducing your taxable income in the year of contribution as well as tax sheltered growth in the account. While Roth contributions are made with post-tax dollars, these accounts still benefit from tax-free growth. - Compounding Power

Additional contributions in your 60s benefit from compounding returns. Even a few extra years of additional savings and growth can make a meaningful difference in your retirement savings. - Bridge the Gap

If you haven’t maximized contributions earlier in your career, this provision gives you a chance to catch up and potentially retire more comfortably.

How to Take Advantage of the Super Catch-Up Contribution

- Review Your Retirement Plan

Confirm with your employer or plan administrator that your plan allows for Super Catch-Up Contributions. Not all plans immediately implement this feature, so it’s essential to verify availability. - Maximize Contributions

Aim to contribute the maximum allowed under your plan, including the Super Catch-Up. If your cash flow is tight, consider reallocating expenses to prioritize retirement savings during these critical years. - Consult a Financial Advisor

A financial advisor can help you navigate the complexities of retirement planning, optimize your contribution strategy, and ensure you’re taking full advantage of tax benefits.

The Super Catch-Up Contribution offers individuals in their early 60s a valuable way to increase their retirement savings. By taking full advantage of this provision, you can make significant strides toward achieving your financial goals and enjoying a secure retirement.

Don’t wait—review your retirement plan, assess your savings strategy, and consult with a financial advisor to ensure you’re maximizing this powerful tool.

1These limits are subject to phaseouts per IRS guidelines. Visit the IRS website for additional detail.

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy,” dba Pekin Hardy Strauss Wealth Management) for informational purposes only and is not intended as an offer or solicitation for business. The information and data in this article does not constitute legal, tax, accounting, investment, or other professional advice. The views expressed are those of the author(s) as of the date of publication of this article and are subject to change at any time due to changes in market or economic conditions. Pekin Hardy cannot assure that the strategies discussed herein will outperform any other investment strategy in the future. Investing involves risk, loss of principal is possible.