Qualified retirement plans are powerful savings tools that can help small business owners and their employees set aside assets for retirement in a tax-advantaged manner. There are many different types of retirement plans available to small businesses, and determining the most suitable type for any business should depend upon its size, its profitability, its ownership structure, and other factors. In this Navigator, we examine the most common types of small business retirement plans and discuss their suitability for various types of businesses. Not participating in some sort of a qualified retirement plan is generally a mistake, in our estimation, as business owners can use retirement plans to cut tax liabilities and improve after-tax investment returns.

Qualified Retirement Plans: Big Benefits for Small Businesses

Small business owners have a lot on their plates. They must make personnel decisions, marketing decisions, purchasing decisions, and the list goes on. One very important decision that may not get the attention it deserves is the type of retirement plan(s) to implement. Employer-sponsored qualified (i.e., tax-advantaged) retirement plans are highly effective savings tools, and they also play a key role in employee benefits packages. Selecting a suitable retirement plan structure is a decision that should not be taken lightly by business owners, as it could have far-reaching consequences for both owners and employees.

Before delving into specific plan types and structures, it is worth taking a moment to think about why a small business owner would want to offer his or her employees access to a qualified retirement plan. Businesses are not required to provide such benefits to their employees, and retirement plans are not without costs. However, from the perspective of the business owner, the benefits of offering a retirement plan usually outweigh the associated costs.

- Research clearly shows that offering a retirement plan improves employee recruitment and retention.1

- Offering retirement plan benefits allows business owners to accumulate sizable tax-advantaged savings for their own retirements.

- Retirement plan expenses help to minimize business income taxes.

For many businesses, establishing and maintaining a qualified retirement plan is truly a win-win for both owners and employees.

With this strong case for offering retirement plans as a backdrop, let’s now examine some of the specific types of retirement plans that small businesses may choose to implement.

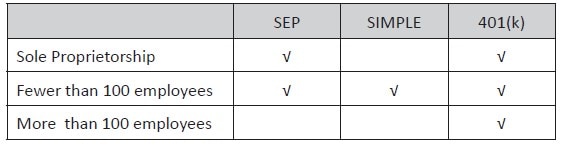

Small businesses can choose from several different types of qualified retirement plans. The most appropriate plan type for a specific business depends on several factors, but the size of the business is a key determinant in selecting an appropriate retirement plan type. Some plan types are more appropriate for smaller businesses or sole proprietorships, while others are more versatile and can be implemented in businesses of widely varying sizes. The table below shows the appropriateness of some popular retirement plan types for businesses of varying size.

SEP IRA

Appropriate for: sole proprietorships, businesses with fewer than 100 employees

A Simplified Employee Pension Individual Retirement Arrangement (“SEP IRA”) is a defined-contribution pension plan designed to provide sole proprietors and small businesses with a low-cost, efficient retirement savings vehicle. SEP IRAs are easy to administer, and they allow for tax-deferred growth before money is withdrawn. Employers and sole proprietors may contribute up to 20% of taxable income to a SEP IRA each year, and the contribution limit rises to 25% if the business is incorporated. Contributions are capped at $56,000 for 2019. SEP IRAs do not require an annual IRS Form 5500 filing, which can help to keep plan administration costs down. 2

Both employers and employees can make retirement contributions to SEP IRA accounts. Contributions made by the employer on an employee’s behalf must be the same percentage for each employee annually. These contributions are treated as a business expense and are not mandatory every year. However, employers must decide each year whether or not to fund their SEP IRA accounts, and, if they make contributions for themselves, they must also make contributions for all eligible employees.

Any employee who has worked for the same employer in at least three of the past five years is generally allowed to participate in a SEP IRA, provided that he or she is at least 21 years of age and earns at least $600 annually. SEP IRAs carry the same rules as traditional IRAs when it comes to employee contributions: employees can contribute up to $6,000 each year or $7,000 if they are age 50 or older for tax year 2019. Sole proprietors are subject to the (higher) employer limits rather than the employee limits.

Similar to traditional IRAs and 401(k) plans, any SEP IRA withdrawals that occur before age 59½ are subject to ordinary income tax as well as a 10% penalty. Withdrawals become mandatory after age 70½. All withdrawals from a SEP IRA are taxed at ordinary income tax rates at the Federal level, regardless of the age at which distribution happens.

SEP IRA assets, like other IRA assets (Roth, Traditional, etc.), can typically be invested in a vast array of investments, limited only by restrictions imposed on the part of the custodian of the plan. In most cases, SEP IRA assets can be invested in stocks, bonds, mutual funds, and ETFs at the account owner’s discretion.

SIMPLE IRA

Appropriate for: businesses with fewer than 100 employees

A Savings Incentive Match Plan for Employees Individual Retirement Arrangement (“SIMPLE IRA”) is an alternative to 401(k) plans for businesses with 100 or fewer employees. Like SEP IRAs, SIMPLE IRAs are defined-contribution plans, and employers can either match employee contributions or simply contribute 2% of employee salaries up to the statutory contribution limits. Employers who match employee contributions may match up to the lesser of 3% of each employee’s salary or $13,000 for tax year 2019 ($16,000 if the employee is 50 years old or more). Taxable corporate income is reduced by the amount of the contributions, while employees and the business owner receive extra tax-deferred compensation via contributions to their retirement accounts. Like SEP IRAs, SIMPLE IRAs do not require an IRS Form 5500 filing.

There are no age limits on participation in a SIMPLE IRA plan. However, withdrawals made before age 59½ will incur a steep 25% penalty if the withdrawal occurs within the first two years of joining the plan and a 10% penalty thereafter, unless a qualifying exemption applies. SIMPLE IRA assets may not be rolled out of a plan (to another employer plan or another IRA) within the first two years of a plan’s existence.

Assets in a SIMPLE IRA, like those in a SEP IRA, can be invested in any securities to which the plan’s custodian has access, including stocks, bonds, mutual funds, and ETFs.

401(K)

Appropriate for: businesses of all sizes

Named for the subsection of the Internal Revenue Code in which they are defined, 401(k) plans are defined-contribution pension accounts that allow employees and employers to set aside tax-advantaged funds for retirement. 401(k) plans are extremely common in the United States, as approximately 79% of Americans work for an employer that sponsors a 401(k)-style retirement plan.3 401(k) plans may be appropriate for businesses of all sizes, from sole proprietorships to very large enterprises with thousands of employees, as plans can be tailored to fit the specific needs of the sponsoring business.

While 401(k) plans are highly customizable, nearly all 401(k) plans share certain characteristics. 401(k) plans allow employees to contribute pre-tax income into a retirement account which can be invested on a tax-deferred basis in a range of pre-determined investment options.4 Taxes are eventually paid at ordinary income rates when distributions take place during retirement. Employers may also contribute to employee accounts, and such contributions reduce taxable income at the corporate level. In a given tax year, an employee may contribute up to $19,000 to a 401(k) plan. Employees over the age of 50 may contribute an additional $6,000 each year as a so-called “catch-up” contribution. Combined employee and employer contributions to an individual’s 401(k) account cannot exceed $56,000 per year ($62,000 for those over 50).

The IRS wants to ensure that 401(k) plans are benefiting all employees, not just the highest-paid employees or owners of companies. For this reason, the IRS requires that 401(k) plans pass annual discrimination testing. These tests seek to determine if key employees/firm owners are benefiting significantly more from the plan than other employees. Plans that do not pass these tests each year can be penalized and may be forced to give contributions back to key employees/owners who must then pay taxes on the returned contributions.

One of the best ways to avoid running afoul of IRS discrimination rules is to implement a Safe Harbor provision, in which employers commit to making mandatory contributions to employee accounts. Employers may choose from three types of mandatory contributions:

- Non-elective Safe Harbor: The employer contributes 3% of each eligible employee’s salary to the plan, regardless of whether or not the employee contributes to the plan.

- Basic Safe Harbor Match: The employer matches 100% of the employee’s contribution up to 3%, then matches 50% of the next 2%. For employees to receive the employer match, they must contribute to the plan.

- Enhanced Safe Harbor Match: The employer matches 100% of the employee’s contribution up to 4%. Employees must contribute to the plan in order to receive the match.

Employers who include Safe Harbor provisions in their 401(k) plans can generally avoid the IRS’s discrimination testing. Such provisions are also popular with employees, as they amount to an effective pay raise, making Safe Harbor 401(k) plans a win-win for businesses.

A 401(k) plan sponsor may also choose to implement a Profit Sharing provision, which allows an employer to make discretionary contributions to employee accounts above and beyond any mandatory Safe Harbor contributions. While Profit Sharing contributions are not capped per se, total annual contributions, including both employee deferrals and any employer contributions, may not exceed $56,000 in 2019 (or $62,000 if the employee is age 50 or above).

OTHER 401(K) VARIATIONS

Businesses can choose from several 401(k) variations, including Solo 401(k) plans and SIMPLE 401(k) plans.

— SOLO 401(K) —

Appropriate for: sole proprietorships

Solo 401(k) plans are 401(k) plans that cover businesses without non-owner employees. Because they only cover owners and their spouses, Solo 401(k) plans are not subject to IRS discrimination testing. However, a Form 5500 filing is still typically required.

Contribution limits for Solo 401(k) plans are the same as for Traditional 401(k) plans ($19,000 or $25,000 for employee deferrals and $56,000 or $62,000 for total contributions). However, because the employer and employee are one and the same, a special calculation determines how much an employer may contribute. Employer contributions are limited to 25% of net income, which is defined as gross income less half of self-employment taxes and all employee deferrals. An example may help to illustrate this calculation:

John is a 45-year-old sole proprietor and earns $150,000 in gross income from his business. He elects to defer $19,000 of his income to his Solo 401(k). His self-employment taxes amount to $20,829.60 (15.3% of the first $132,900 of income plus 2.9% of income above $132,900). Therefore, John can make an employer contribution of $30,146.30 to his Solo 401(k).

25% * ($150,000 – $19,000 – 0.5 * $20,829.60) = $30,146.30

— SIMPLE 401(K) —

Appropriate for: businesses with fewer than 100 employees

Like SIMPLE IRAs, SIMPLE 401(k) plans are useful for small businesses with 100 or fewer employees. Like Traditional 401(k) plans, they allow for employee deferrals (up to $13,000 in 2019 or $16,000 if the employee is age 50 or older). However, unlike other 401(k) plans, SIMPLE 401(k) plans require employers to contribute to each eligible employee’s account according to one of the two following methodologies.

1. A matching contribution up to 3% of each participating employee’s pay

2. A non-elective contribution of 2% of each eligible employee’s pay, regardless of participation. No employer contributions are required beyond those listed above, and employees are fully vested at any contribution level. SIMPLE 401(k) plans are not subject to IRS discrimination testing, but a Form 5500 filing is required.

SIMPLE 401(k) plans are very similar to SIMPLE IRA plans, with one primary exception: SIMPLE IRAs do not allow participants to take loans from their accounts, while SIMPLE 401(k) plans do. A business owner who wants the option of taking loans from his or her account or who wants to offer such an option to employees without having to deal with IRS discrimination testing may find it attractive to implement a SIMPLE 401(k) plan.

CASH BALANCE PLAN

Appropriate for: businesses of all sizes with highly predictable cash flows

A cash balance plan is a defined benefit plan that allows individuals in predictably profitable businesses to set aside substantial amounts of retirement money each year on a pre-tax basis. Such amounts are typically made in addition to contributions made to a 401(k) plan and/or a profit-sharing plan. Cash balance plans differ from other defined benefit plans (i.e., traditional pension plans) in that they define promised benefits in terms of an account balance, rather than a monthly or annual payment. Unlike defined contribution plans, investment risks related to a cash balance plan are borne by the employer, not the employee. Given this structure, one might think of a cash balance plan as a sort of “hybrid” retirement plan that incorporates characteristics of both defined benefit plans as well as defined contribution plans.

Cash balance plans offer significant benefits to participants, chief among them being the ability to make large tax-deductible contributions each year, well in excess of those allowed by traditional 401(k)/profit sharing plans ($56,000 or $62,000). Technically, cash balance plans do not have an annual limitation on contributions. Instead, cash balance plans have a maximum lump sum amount that can accumulate for any one participant, meaning that the annual contribution amount allowed is a function of the interest credit rate and the participant’s age.5 Younger participants have lower annual contributions because they have more years to accumulate the maximum lump sum amount.

While cash balance plans can be implemented by businesses of all sizes and are typically highly beneficial for participants, they are also relatively complex and typically require professional assistance in plan design and maintenance. For this reason, cash balance plans may only be appropriate for a small subset of businesses.

CLOSING THOUGHTS

Our discussion of small business retirement plans has not been exhaustive, as there are countless variations and iterations of the various plan types outlined above. Many plan types can be customized to fit the specific needs of the sponsoring business. The most important takeaway here is that all small businesses can find a retirement plan that works for them, and business owners should do whatever they can to participate to the maximum extent possible in that retirement plan.

If you are considering implementing a qualified retirement plan for your small business or you are considering making changes to your existing retirement plan, please reach out to us to discuss potential solutions.

- https://business.betterment.com/wp-content/uploads/2018/08/2018-08-22-B4B-Customer-Survey-Report.pdf

- IRS Form 5500 is an annual report filed with U.S. Department of Labor (DOL) that contains information about a qualified retirement plan’s financial condition. Filing of a Form 5500 typically requires the involvement of a tax professional.

- U.S. Census Bureau.

- Some 401(k) plans allow participants to make after-tax Roth contributions as well.

- A plan’s interest credit rate is a guaranteed rate of return as specified by the plan document. It is typically tied to long-term Treasury yields or is stated as a low, fixed rate (e.g., 3% per annum).

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only. The information and data in this article does not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions.