Roth IRAs can be highly useful retirement savings vehicles for investors.. While it is true that you cannot deduct contributions to your Roth IRA, you can withdraw your money tax-free down the road in retirement if the appropriate holding period and age requirements are met. If your income level is above the minimum threshold, however, direct Roth IRA contributions are not permitted; thus, the back-door Roth IRA strategy allows savers who have a high income to nevertheless make annual Roth IRA contributions.

Why Contribute to a IRA?

While the annual contribution maximums are capped at relatively low levels, regularly contributing to an IRA can add up to a significant portion of your retirement nest egg over time. Money contributed to an IRA can grow and compound over time unfettered by the drag of taxes. We covered the advantages of IRAs in some depth in our March 2024 issue of The Navigator. Key highlights from that piece include:

- For savers in the highest income tax bracket, contributing the maximum of $7,000 to an IRA account annually over a 30-year period can result in balances that are more than 30 percent higher than the same amount saved in a taxable investment account.

- Shielding your savings and investments from taxes is especially relevant for those in higher Federal income tax brackets and those who live in states with relatively high-income tax rates.

- Rebalancing investments inside an IRA account has no tax consequences due to the tax shield.

While there are several variants of IRAs, the two most popularly utilized ones are the traditional IRA and the Roth IRA.

The Traditional IRA

Traditional IRA contributions can be made with either or both pre-tax and post-tax money. Your ability to make pre-tax IRA contributions is dependent upon your income level and whether you are covered by a workplace-sponsored retirement plan, such as a 401(k), 403(b), or 457(b) plan.

Regardless of whether your contributions are tax deductible, your traditional IRA investments grow tax-deferred until withdrawn at retirement. At that point, all withdrawals are subject to taxes at your ordinary income tax rate, except for the value of your post-tax contributions (if any). Additionally, your capital held in a traditional IRA account is subject to annual required minimum distributions (RMDs) starting at age 73.

The ROTH IRA

Contributions to Roth IRAs are made with after-tax money; that means that there is no tax deduction available for any contributions to Roth IRAs. Conversely, your Roth IRA has two significant advantages over traditional IRAs: 1) your Roth IRA capital, including all investment gains, can be withdrawn tax-free at retirement, and, 2) Roth IRAs are not subject to RMDs.

The former advantage (tax-free distributions) offers enormous tax savings compared to a traditional IRA if you comply with the five-year rule, which allows tax-free withdrawals from a Roth IRA if your first Roth contribution was made at least five years prior to the withdrawal and if you are at least 59½ years old. Beyond these simple rules, there are a litany of other rules stipulating the qualifications for making tax-free Roth withdrawals. If you decide to go the Roth IRA route, you should consult with your accountant to make sure that you understand these rules.

Assuming your withdrawals are compliant with the regulations, rather than paying taxes on distributions at ordinary income tax rates, you will pay no taxes at all. With a Roth IRA, your contributions can always be withdrawn free of tax or early penalties. However, if you are under 59 ½ years old or have not satisfied the five-year rule, your investment earnings will likely be taxable, and an additional penalty may apply.

The lack of RMDs can also be a huge benefit in your estate planning efforts. It is a favorable estate planning technique to pass a Roth IRA on to non-spousal beneficiaries because heirs are not taxed on most distributions from an inherited Roth IRA.

ROTH IRA Contribution Restrictions – The Reason for a Back-Door ROTH IRA

High-income investors make back-door Roth IRA contributions because they are not allowed to contribute directly to their Roth IRAs due to IRS income limitations. For 2024, the income restrictions begin for single and household filers at $146,000 and for married filing jointly at $230,000. If your income is below these levels, there is no need to consider a back-door Roth IRA strategy; you can just make a direct Roth IRA contribution.

Roth IRAs, like all IRA accounts, have a maximum annual contribution limit of $7,000 for 2024, with an incremental $1,000 contribution available for those who are age 50 or over at any point during the year.

How a Back-Door ROTH Conversion Works

High-income investors make back-door Roth IRA contributions because they are not allowed to contribute directly to their Roth IRAs due to IRS income limitations. For 2024, the income restrictions begin for single and household filers at $146,000 and for married filing jointly at $230,000. If your income is below these levels, there is no need to consider a back-door Roth IRA strategy; you can just make a direct Roth IRA contribution.

Roth IRAs, like all IRA accounts, have a maximum annual contribution limit of $7,000 for 2024, with an incremental $1,000 contribution available for those who are age 50 or over at any point during the year.

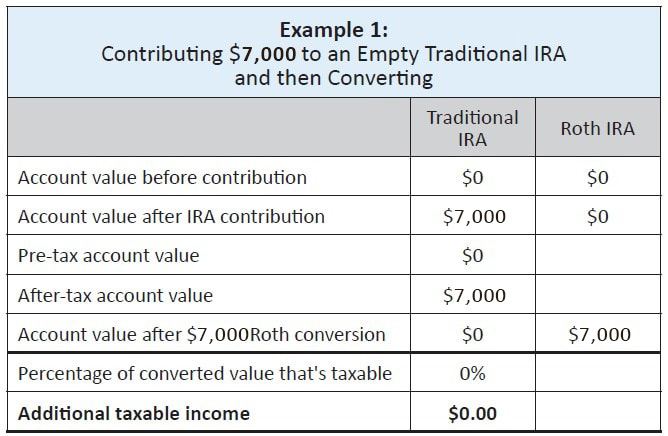

For example, if you make an after-tax contribution of $7,000 to a traditional IRA and convert it shortly after to a Roth IRA, you will likely owe no taxes or a very nominal amount if there were any earnings on this money during the short period of time in which it was held in the traditional IRA. If this contribution represents the only traditional IRA assets that you own, the process is very straightforward, and we have illustrated the math in the table below.

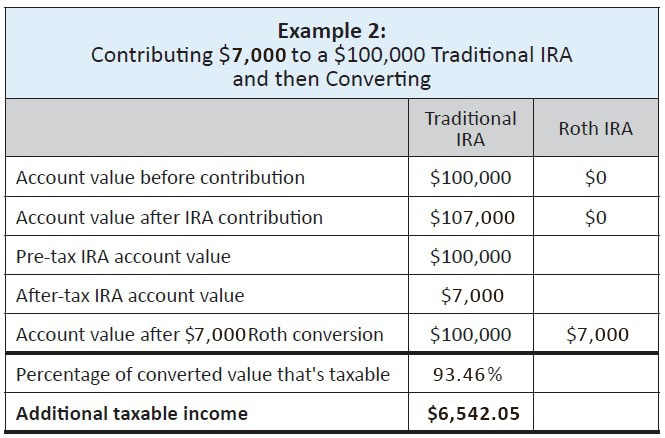

However, if you have other pre-tax traditional IRA money, then the rules get a bit more complicated. The IRS aggregation rules state that, where there is other pre-tax traditional IRA money, these other IRA funds will be treated as if they are all in a single account for distribution purposes which include Roth IRA conversions. Put differently, a significant amount of pre-tax IRA money can complicate the back-door Roth process.

For example, let’s assume instead you want to contribute $7,000 post-tax to a traditional IRA and then convert the money to a Roth IRA. In this example, you are also starting with an additional $100,000 in pre-tax money in your traditional IRA account.

Because most of your IRA capital has never been taxed, the IRS aggregation rules mandate that only a portion of the $7,000 that you wish to convert to Roth IRA can be done on a tax-free basis. In this case, your taxable income would increase by more than $7,000, as we have illustrated below:

As you can see from the second example, if you have a sizeable amount of capital in a traditional IRA account that was contributed on a pre-tax basis, doing a back-door Roth or any Roth conversion can carry potentially steep tax consequences. However, it is worth noting that some employer-sponsored retirement plans have “roll-in” provisions that may allow individuals to move IRA assets into a 401(k) or similar plan and thereby eliminate the IRA assets from the back-door Roth calculations.

Before making any Roth IRA conversions, you should take your overall income and tax situation into consideration on a year-to-year basis. If all or most of a planned Roth conversion will be taxed, you should make it a point to time the conversion so that you do it in a year when your income might be lower than normal.

Is a Back-Door ROTH IRA Worth the Trouble?

The trade-off between a Roth IRA and a traditional IRA is whether you want to pay taxes when you take RMDs in the future with traditional IRAs or miss out on the deductions available today through the contributions. Beyond that, RMD requirements and estate planning considerations play a role as well.

Paying taxes now or later has become an even more important issue with the tax reform legislation passed in late 2017. While tax rates will be lower for many taxpayers, these lower rates expire after 2025. Unless the laws change again, tax rates are projected to rise automatically; beyond that, many believe that taxes will be forced to increase to fund the expected deficits caused by the tax reform rules. Time will tell, of course.

Whether it is better to pay taxes now, with the benefit of tax-free withdrawals in the future, or to receive a tax break now and pay taxes later is a function of your view of whether your income tax rate will rise or decline in the future. It is also the classic case of the time value of money problem. Is a dollar of tax savings today worth more than a dollar of tax-free income down the road? As your financial advisor, we can help you examine this critical question.

Eliminating or reducing RMDs is another reason to consider having some retirement assets in a Roth account. Depending upon the size of your traditional IRA plus any employer-sponsored retirement account money, your RMDs could wind up being very significant, resulting in a sizable tax bill each and every year in retirement.

Roth IRAs can also be an effective estate planning tool since RMDs are not required with Roth IRAs. This money can stay protected in this tax-deferred vehicle if not withdrawn and can be passed to heirs without being depleted via RMDs. If you are married, your spouse can inherit a Roth IRA and treat it as his or her own with the same tax benefits.

ROTH 401(k)

While the back-door IRA conversion strategy is useful for many people, contributing to a Roth 401(k) plan (or a Roth 403(B) or a Roth 457(b) plan) at work is also an attractive strategy for retirement planning. If you have the option available at work, a Roth 401(k) has no income limitations that would reduce or prohibit the amount contributed. Furthermore, the only contribution limits are the allowable contributions, which are $23,000 for people below the age of 50 and $30,500 for those over 50.

If you contribute to a Roth 401(k), you will not be able to deduct any of these contributions from your current taxes. Again, the decision here should be driven in part by whether you think your tax rate will increase or decrease in the future.

It should be noted that once you leave your employer, your Roth 401(k) account can be rolled over to a Roth IRA without tax consequences.

Closing Thoughts

Roth IRAs can play an important role in your retirement savings strategy. For high-income investors, your best shot at contributing to a Roth retirement program might be utilizing the back-door Roth strategy each year.

If you would like to learn more about the back-door Roth or about where a Roth IRA fits in your retirement savings strategy, contact your portfolio manager here at the firm to discuss your options. Furthermore, we encourage you to consult with your tax advisor before making any decisions.

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only and is not intended as an offer or solicitation for business. The information and data in this article does not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Pekin Hardy cannot assure that the strategies discussed herein will outperform any other strategy in the future, there are no assurances that any predicted results will actually occur.