“There are decades where nothing happens,

and there are weeks when decades happen.”

─ Vladimir Ilyich Lenin

Out of seemingly nowhere, the world is engaged in the most significant crisis since World War II. First and foremost, this is both a health crisis and a humanitarian crisis, with the estimated number of expected deaths from the coronavirus ranging from 50,000 to 200,000 just in the United States. Needless to say, some things are more important than the financial markets, such as your health, the health of your loved ones, and the health of the community at large. We are grateful for our healthcare workers, who are taking significant risks to help others, and to all of the other people who continue to work to provide essential products and services to the general public. We are also concerned about the economic damage caused by the worldwide shutdown and hopeful that the pandemic dissipates sooner rather than later so that everyone can begin to return to their pre-crisis lives.

The shutdown, while saving many lives, has resulted in a sudden stop of the global economy, with devastating results on the cash flows and balance sheets of individuals, corporations, and governments alike. Even more concerning, the global economy entered this crisis entirely unprepared, with record levels of debt. An enormous and sudden cash flow shortfall combined with record indebtedness is a certain recipe for a debt deflation and depression without government interference. And, sure enough, to make sure a depression doesn’t happen, the United States and other countries are embarking upon a level of economic and market intervention that is unprecedented in the West. For now, it may not be enough, given the deflationary forces surging through the economy; stock prices are lower, commodity prices have crashed, small businesses have been shuttered, unemployment is skyrocketing, and bankruptcies are rising.

Without a doubt, the U.S. government will unroll further interventions to arrest the deflationary forces unleashed by the shutdown until the current deflation wave morphs into inflation, and quite possibly a high level of inflation. With the newly signed CARES Act, the U.S. government is embarking upon “helicopter drops” of money as famously described by Ben Bernanke in the 2002 anti-deflation speech that earned him his job as Chairman of the Federal Reserve several years later:

In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities. A broad-based tax cut [not just for the wealthy], for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices.

Through the CARES Act, the U.S. government is distributing money broadly to U.S. citizens through a combination of tax cuts, outright payments, and forgivable loans, and financing it through open-market purchases, also known as money printing, on the part of the Federal Reserve. Although the CARES Act will be injecting more than $2 trillion into the U.S. economy, we suspect that the CARES Act may be just the first in a series of helicopter drops.

We will be referencing this famous Ben Bernanke speech, titled “Deflation: Making Sure ‘It’ Doesn’t Happen Here,” multiple times in this note. It is a speech worth reading slowly, in full, because it represents the full playbook of how policymakers are attempting to combat the deflation that is currently occurring. Also, while analyzing the economic and financial implications of new legislation in this note, we want to make clear that we hesitate to second-guess either Congress or the Federal Reserve for the actions currently being taken. It makes enormous sense to provide financial assistance as quickly as possible to businesses that have closed or to employees who have lost their job as a result of the shutdown.

As a result of the coronavirus shutdown and the fiscal and monetary response, an epic battle is taking place between the forces of deflation and inflation. The current deflationary wave is powered by the worst fundamental economic data since the Great Depression and a record level of debt. The future inflation will be driven by accelerating fiscal deficits, a soaring U.S. debt level that will need to be managed by inflating it away, and a Federal Reserve with unlimited printing power. Ultimately, we expect inflation to win this tug of war because policymakers are limited only by their willingness to print and spend money and because, given the amount of debt soon to be outstanding, they will have no other alternative. However, we do not know if inflation’s eventual victory will occur in two months or two years. It is impossible to forecast the independent variables, such as the length of the shutdown, policy decisions, and the willingness of economic participants to hold onto fiat currencies that are being diluted aggressively.

With that backdrop, we want to share with you our current thinking across several different asset classes.

- Gold

In Ben Bernanke’s anti-deflation speech, he referenced a historical event in 1933 which marked an important turning point for gold and for the economy in the Great Depression:

A striking example [of an effective weapon against deflation] from U.S. history is Franklin Roosevelt’s 40 percent devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly.

Gold, in the current monetary era, has not been purchased by the Federal Reserve, but it has been purchased aggressively by other central banks ever since the Financial Crisis. Since 2014, in particular, central banks have refrained from accumulating U.S. Treasuries, choosing to buy gold instead. That the United States has not purchased gold yet is largely due to its desire (so far) to uphold the dollar’s role as the world’s reserve currency.

The Dutch central bank (DNB), on its webpage, explains why it owns gold. We share it with you because the DNB’s rationale could apply just as well to individual investors, too:

Shares, bonds and other securities are not without risk, and prices can go down. But a bar of gold retains its value, even in times of crisis. That is why central banks, including DNB, have traditionally held considerable amounts of gold. Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again.

During the coronavirus crisis, gold has performed relatively well. In any other currency besides the U.S. dollar, gold’s recent performance has been nothing short of spectacular. As policymakers combat deflation today, we do not know whether gold’s price will increase suddenly, through an explicit devaluation akin to what President Roosevelt did in 1933, or gradually, as a result of lower interest rates and increased deficit spending. Regardless of the precise policy path taken, we continue to view gold as a wealth asset unlike any other financial asset.

- U.S. Dollars (cash)

Cash has outperformed all asset classes besides gold during the current coronavirus pandemic. In a deflation, cash is king. Everybody is scrambling to obtain dollars, especially people and companies who are experiencing cash flow or balance sheet problems. U.S. policymakers understand this, which is why Congress is preparing to helicopter drop trillions of dollars to taxpayers and small businesses, and it is also why the Federal Reserve is printing billions of dollars to fund that spending while also purchasing U.S. Treasuries, corporate bonds, municipal bonds, and mortgage-backed securities to keep their debt service costs low.

The CARES Act, passed at the end of March 2020, perfectly matches Ben Bernanke’s description of an effective stimulant to prices (and inflation). That it hasn’t yet caused inflation is either because it’s too early, in that the money hasn’t arrived yet and can’t be spent, or because it’s not enough, in which case far more money will likely be provided soon. When the CARES Act and other acts yet to be passed convert deflation into inflation sooner or later, the inclination of people and companies to hold cash will reverse along with the dollar’s ability to maintain its value.

- Long-Term U.S. Treasuries

As we write this letter, thirty-year Treasuries offer a yield-to-maturity of 1.23%. One of the reasons that the yield is so low is that, in March, the Federal Reserve began buying U.S. Treasuries, including long-term U.S. Treasuries, to combat deflation, to finance U.S. deficit spending, and keep U.S. government borrowing costs low. Ben Bernanke suggests exactly this remedy in his deflation speech:

Lower rates over the maturity spectrum of public (and private) securities should strengthen aggregate demand in the usual ways and thus help to end deflation… Historical experience tends to support the proposition that a sufficiently determined Fed can peg or cap Treasury bond prices and yields at other than the shortest maturities.

With a yield-to-maturity of 1.23%, investors are hardly being compensated for the potential inflation that the U.S. government might be creating with its stimulus programs. If the average inflation rate over the next thirty years is anything above 1.23%, which seems highly likely, U.S. Treasuries would generate a negative inflation-adjusted return for long-term investors.

- Corporate Bonds

Corporate bonds typically generate a yield that is equivalent to the prevailing Treasury bond rate plus a “credit spread” of additional interest to compensate investors for bearing credit risk. During the recent crash, credit spreads increased considerably, and corporations were momentarily unable to issue debt at a reasonable interest rate. This development, while rare, commonly occurs during waves of severe financial dislocation. Unfortunately, too many corporations are in a similar position to the U.S. government in that they have excessive debt on their balance sheets and therefore require low interest rates to avoid defaulting on their financial obligations.

Ben Bernanke offered a solution to this problem in his deflation speech too:

Therefore a second policy option…for the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral. For example, the Fed might make 90-day or 180-day zero-interest loans to banks, taking corporate commercial paper of the same maturity as collateral. Pursued aggressively, such a program could significantly reduce liquidity and term premiums on the assets used as collateral. Reductions in these premiums would lower the cost of capital both to banks and the nonbank private sector, over and above the beneficial effect already conferred by lower interest rates on government securities.

Let us translate this passage of the speech: in order to place a cap on corporate borrowing costs and reduce the risk of widespread corporate defaults, the Federal Reserve began purchasing investment-grade corporate bonds last month for the first time in history. Almost immediately after this announcement, corporate bond prices increased while corporate bonds spreads compressed. We expect the Federal Reserve will continue to cap corporate borrowing costs for the foreseeable future, limiting the interest rate that private investors in corporate bonds (like our clients) might receive.

- Stocks

We already shared a passage concerning the 1933 gold devaluation, but there is also an end to Ben Bernanke’s story:

[After the gold devaluation,] the economy grew strongly, and by the way, 1934 was one of the best years of the century for the stock market. If nothing else, the episode illustrates that monetary actions can have powerful effects on the economy, even when the nominal interest rate is at or near zero, as was the case at the time of Roosevelt’s devaluation.

We agree with Ben Bernanke in that monetary actions can have powerful effects on the economy. For now, the CARES Act along with monetary stimulus has arrested the decline in the stock market. With that said, volatility and valuations remain very high, and bear markets do not typically end quickly. Historically, bear markets end after a period of revulsion towards the stock market, when all hope is lost and there is a feeling of capitulation. To date, we have experienced panic and forced liquidations, but the abrupt reversal of the stock market along with elevated valuations do not fit the historical pattern of the end of bear markets.

At all times, we believe it is important to maintain a high level of investment standards. We aim to buy strong companies inexpensively and take advantage of mispricings. Thus far, we have moved slowly to commit additional capital towards buying stocks, for the following reasons:

- Quickly deteriorating economic fundamentals: The level of uncertainty is currently extremely high and exceeds that of the 2008/2009 Financial Crisis. While stocks have declined in price, most declines have matched deteriorating fundamentals and intrinsic values. A share price decline alone does not necessarily mean that a stock is cheap.

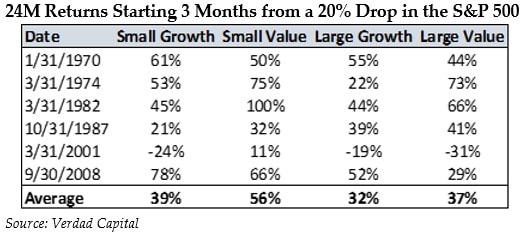

- Overvaluation: S. stocks are not as excessively overvalued as they were at the beginning of the pandemic, but they are still overvalued. At the end of March 2020, the Cyclically Adjusted PE ratio (CAPE) as pioneered by the economist, Robert Schiller, was at 23x, still within the most expensive quintile compared to history. In the table below, we present a historical analysis of returns since 1957 over the two-year periods that take place after a 20% drop in the S&P 500 Index. Small-cap outperforms large-cap, while value outperforms growth. While returns are generally positive, stocks generally fared poorly after 2001 because the market drop also started from such an overvalued starting point.

- Wide range of intrinsic values: Companies that are having “temporary problems” due to coronavirus-related disruption are not just experiencing revenue softness; in some cases, companies are experiencing 70% or more revenue declines while the global economy remains closed. We are finding ourselves performing a balance sheet analysis that we have never done before when we attempt to answer the question, “How many months can this company survive with zero revenues?” This same phenomenon also creates wide ranges of potential intrinsic values.

We are navigating the current environment as we navigate any situation, with prudence and discipline and patience. We are being humble about our ability to predict the trajectory of the coronavirus spread or future policy decisions. We are researching companies that we would like to buy at the right price, even if that price hasn’t been reached yet.

We suspect, by the time this bear market ends, we will have plenty of opportunities to buy great companies at great prices. And, if inflationary forces start to accelerate, stocks should serve to protect the real value of your invested capital better than bonds.

- Commercial Real Estate

The coronavirus shutdown is creating difficult circumstances for some real estate investors. Businesses and consumers across the country are asking for rent waivers and rent deferrals because tenants, in turn, are having their own cash flow problems. For real estate investors with too much leverage, this could become a big problem. WeWork, for example, once valued at $47 billion, seems headed for a debt default, as do numerous investors who purchased multiple Airbnb rental properties with excessive leverage.

For long-term investors who do not have too much leverage and can survive the current shutdown, commercial real estate could provide some inflation protection, and opportunities to buy distressed properties later this year are likely to arise.

- Commodities

Unlike gold, most commodities have declined significantly in price over the past 60 days due mainly to an enormous and rapid decline in aggregate demand. Oil, in particular, has captured much attention, as Russia and Saudi Arabia are attempting to capture additional market share (perhaps by severely injuring highly leveraged U.S. shale producers) rather than reduce supply. Marginal commodity producers are declaring bankruptcy, while almost all commodity producers are curtailing capital expenditures significantly.

Importantly, most commodity prices have been declining from their all-time peaks for the past decade. With lower commodity prices, producer profits have been declining, and capital expenditures have been cut. This means that the ability of producers to produce additional supply in the future is limited. The best cure for low prices is low prices, and low prices have been very persistent in recent years; when aggregate demand returns to normal levels, we expect commodity prices along with producer profits to increase.

The financial system is currently having such difficulties not because of the coronavirus per se, in our view, but because the Federal Reserve and other central banks kept interest rates too low for too long over the last two decades, allowing governments, corporations, and consumers to build up unsustainable debts. At the end of 2019, global debt exceeded $255 trillion, representing 322% of global GDP, which was forty percentage points higher than at the onset of the 2008 financial crisis. According to the Institute of International Finance, if net government borrowing doubles from 2019 levels, which is likely to happen, and there is a 3% nominal decline in global GDP, global debt will increase from 322% of GDP to 342% in 2020.

More economically deadly than any pandemic, untenable financial obligations abetted by excessively dovish monetary policies are the root cause of both the current deflation surging through financial markets and the future inflation waiting in the wings. The coronavirus has simply served as the straw that broke the camel’s back.

We have been sending out more client correspondence via email than usual in recent weeks, trying to keep you up to date on developments that might affect your investment portfolio, your business, or your financial plans. History is moving very quickly right now, and we are doing our best to help you understand and interpret these developments. If you have a topic you would like to discuss, please do not hesitate to reach out to your portfolio manager. We hope you stay safe and healthy, and we wish the same for each and every one of your loved ones.

Pekin Hardy Strauss Wealth Management

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Past performance is no guarantee of future results. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy, focusing on the large-cap segment of the market.