In personal finance, women face a different set of challenges than men. Some of these challenges are well known, like the wage gap, and some have only recently begun to be discussed, like the effect that has become known as the “wealth gap.”

Estimates of the wealth gap attempt to capture the cumulative, lifetime effect that being a woman has on a woman’s assets relative to a man’s, and the results are often striking. A recent study from Bank of America Merrill Lynch and Age Wave estimated that if a man and a woman work at the same median wage over the same period of time but the woman takes time off for caregiving, the woman may have as much as $1 million less than the man at retirement.1

The wealth gap between men and women can be extremely significant and have a tangible impact on women’s lives before and after retirement. Below, we discuss some of the challenges women face when it comes to accumulating wealth as well as some steps women can take to secure their financial future.

What’s Causing the Wealth Gap?

In the example above, a significant wealth gap was produced just by assuming that a woman took time out of the workforce to care for children and parents, but in reality, caregiving is only one cause of the problem. Differences in wage rates and types of work, lifespan, and lower rates of investment all contribute to a substantial wealth gap between men and women.

The Wage Gap

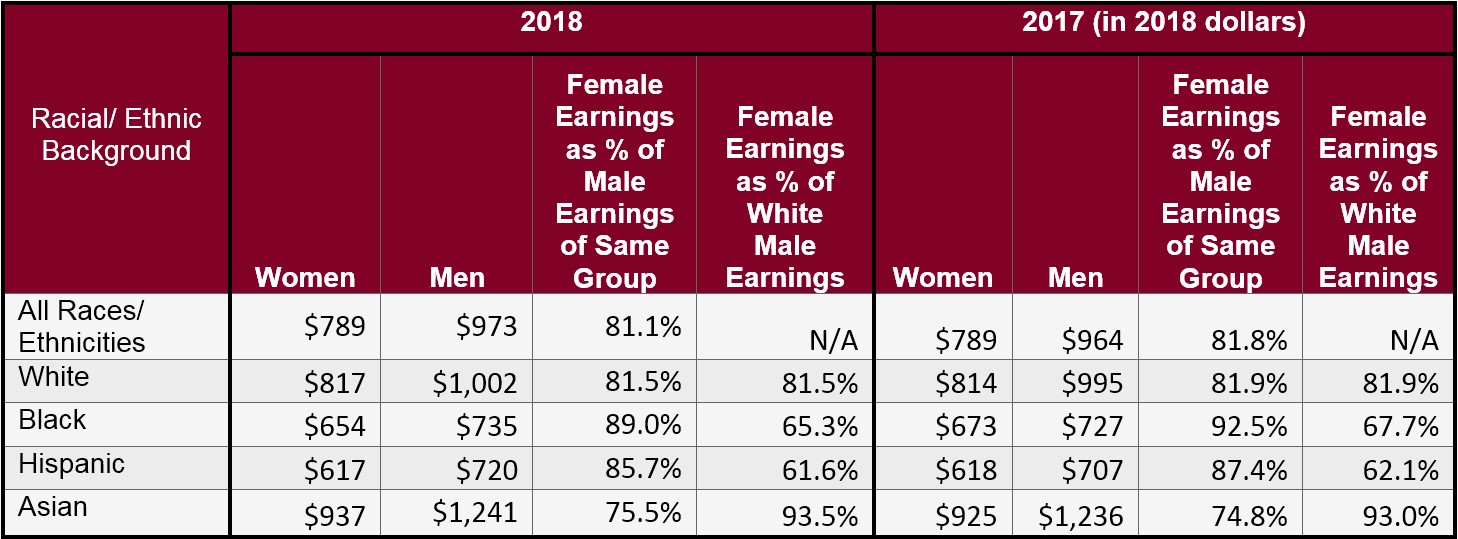

In 2018, women in full-time jobs earned, on average, 81 cents for every $1 earned by men. Black and Hispanic women earned significantly less than the average—just 65 and 62 cents respectively. If all workers are included, the gap in earnings becomes even larger, as women are more likely to hold part-time jobs.2

Median Weekly Earnings and Gender Earnings Ratio for Full-Time Workers, 16 Years and Older by Race/Ethnic Background, 2017 and 2018  Source: The Gender Wage Gap: 2018 Earnings Differences by Race and Ethnicity, Institute for Women’s Policy Research

Source: The Gender Wage Gap: 2018 Earnings Differences by Race and Ethnicity, Institute for Women’s Policy Research

While the wage gap is due to several factors, including lower pay in jobs done primarily by women, a lack of leave and support for pregnant women and new mothers, and discrimination in salaries and hiring, the end result is that women earn significantly less. According to the Institute for Women’s Policy Research, if women were paid the same as men in comparable jobs, almost 60% of women would be making more money than they do now, and the poverty rate among women would be halved.

The pay gap has implications for women today, of course, but the effect of the pay gap is compounded over the course of a woman’s life. Over the length of a career, the wage gap makes women significantly less well off than their male counterparts in the same roles.

Breaks in Workforce Participation

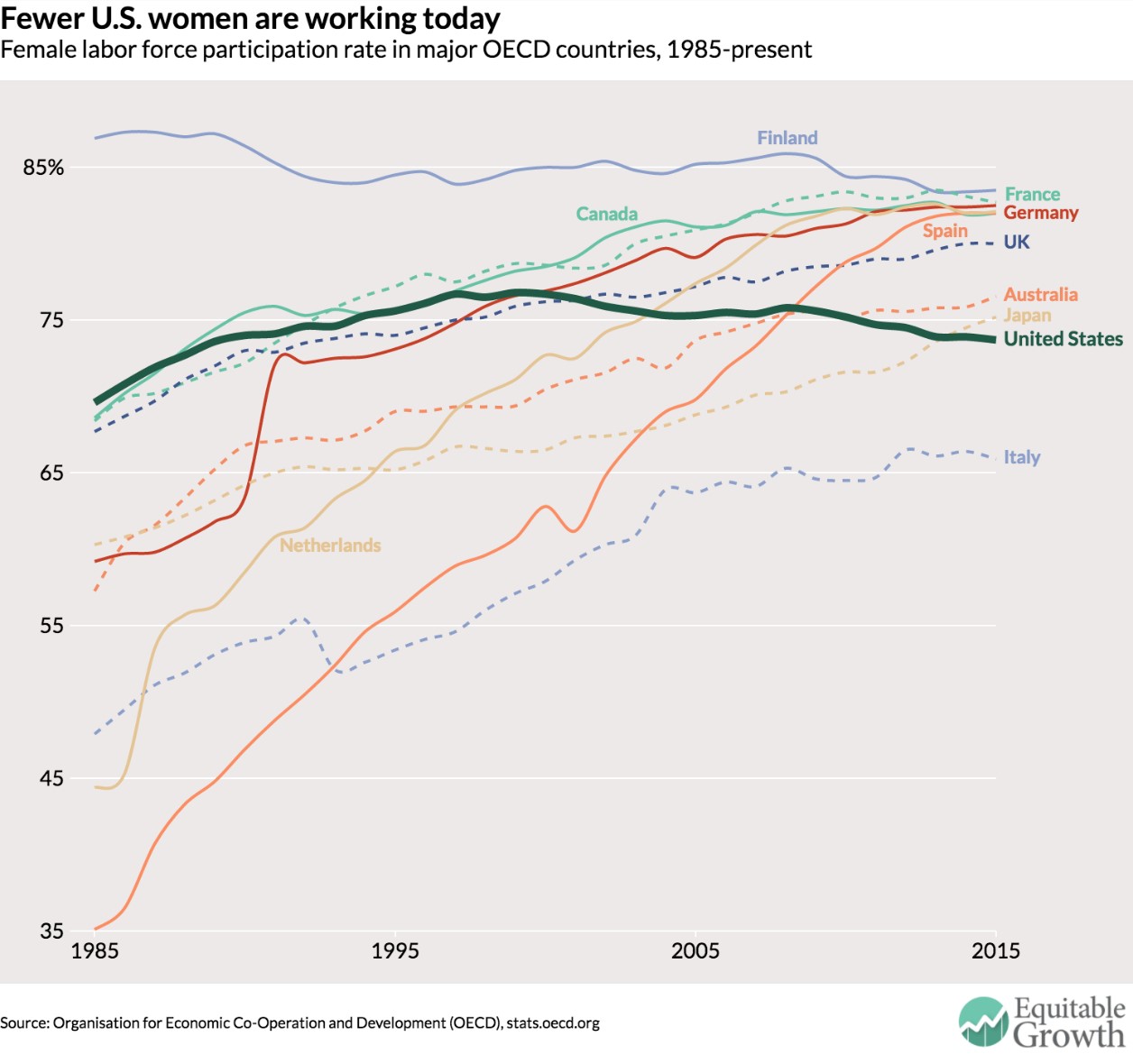

Women are paid less than men on average, and they are also much more likely to take meaningful breaks from the workforce to become an unpaid caregiver. This break often coincides with motherhood, as childcare expenses can be prohibitively expensive and quality childcare hard to find. Often, women leave the workforce or reduce to part-time work hours in order to care for their children. Studies have shown that women who are unable to find childcare are significantly less likely to be employed than those who do have childcare, but the presence or absence of childcare has no effect on men’s employment. High childcare costs and a lack of family support policies in the U.S. have contributed to the stalled growth in women’s labor force participation over the past two decades.3 In other major developed nations—nearly all of which provide some sort of parental support—women’s participation rate has continued to grow. 4

Women are also more likely than men to take up unpaid caregiving work for their aging parents. The U.S. Bureau of Labor Statistics estimated that there were over 40 million unpaid eldercare providers in 2015/2016 and the majority of those providers were women.5 Parental caregiving responsibilities tend to begin when women reach their mid-40s, at which point women’s earning potential begins to drop. At this age, women typically would be saving more heavily for their own retirement, and reentering the workforce could become extremely difficult. One study estimated that women lose an average of $324,044 in compensation due to eldercare.6

Taking time out of the workforce to care for children or parents causes women to sacrifice not just their salary in those years, but also the benefits of qualified, employer-sponsored retirement plans, health insurance, wages that contribute to their ultimate Social Security benefit, and perhaps their ability to save at all.

Lifespan

One biological complication that women face is that they simply live longer than men by an average of two years.7 A woman’s portfolio will likely need to support her for two additional years of retirement than the average man, which requires an even greater amount of saving.

The other important implication of these extra two years is that women will, on average, have to pay more for healthcare expenses in retirement than men. A study by HealthView Services estimates that a healthy 65-year-old woman can expect to pay, on average, $306,426 for all healthcare costs in retirement, whereas a healthy 65-year-old man will pay $260,422 (costs in future dollars).8

The Investment Gap

Compounding all these issues over time is what has come to be known as the “investment gap.” Women are better savers than men, but they are less likely to invest the money that they save. A BlackRock survey found that men hold 60% of their assets in cash whereas women hold 71%.9 It may be low risk to hold assets in cash, but that safety comes at the expense of the returns that women could potentially realize on invested assets. On average, men are investing more of their net worth into the stock market and growing that additional investment over time.

On average, women are paid less than men, are more likely to leave the workforce for a significant period of time (or two periods), are likely to live longer and require more medical care, and are less likely to invest the money they have. Together, all of these factors lead to a significant wealth gap between men and women.

What Women Can Do

Many of the issues described above are out of the hands of individuals and would probably require a policy response at the local or Federal level before the wealth gap would begin to close. Change may come, but it is likely to come slowly, and women who are currently saving for retirement shouldn’t wait for better policies to solve the problems. The difficulty in addressing these structural issues makes it even more important that women take control of their own finances to the extent that they are able.

Invest More

For many women, a simple change with a large long-term impact on personal wealth is to invest more. Women tend to be better savers than men: a Vanguard study found that women were more likely to participate in 401(k) plans than men and put away 7-16% more of their income than men.10 Women are already doing the necessary work to grow their wealth by putting money aside, and putting more of those savings into the market rather than bank accounts would help to close the investment gap.

Despite the lower investment rate among women, research has shown that women make better investors than men. The cliché of investing is that men are bold risk-takers and women are too risk-averse to make any money in the stock market. In reality, there may be some truth to this cliché—but with the opposite outcome. Studies have repeatedly shown that women achieve higher average returns than men, in part because they do tend to be more risk-averse. In one such study from Warwick University, men were more likely to make speculative bets on fluctuating stocks, hold onto stocks that were losing value, and make frequent trades, which increased transaction costs in their portfolios. Women, on the other hand, were more likely to put their money into diversified funds with good track records and then leave the money there. As a result, women outperformed men, on average, by 1.8% per annum.11

Only 52% of women report that they are confident in managing their investments as opposed to 68% of men.12 This confidence gap has real consequences for women’s lives and is unwarranted based on what we know of how women invest. Despite popular opinion about women and investing, women are successful investors and should strive to invest more of their savings into the market.

Delay Social Security

Choosing when to take Social Security benefits is one of the most important retirement decisions. Those who are eligible to receive Social Security benefits can begin them as early as age 62 and as late as age 70. At age 66, the “full retirement age,” a retiree would receive 100% of their monthly benefit amount; taking Social Security earlier reduces the benefit amount and taking it later increases the monthly payment. While the choice of when to take Social Security is very complex and individualized, it is generally true that the longer a retiree expects to live, the better off they are delaying their benefit.

As discussed above, women are statistically likely to live longer than men, so the average woman would benefit from delaying Social Security as long as possible. Of course, this depends upon a woman’s health, family history, financial condition, and more, but in general, women should assess their ability to delay Social Security as they approach retirement.

Have a Plan

While women may not have much direct control over many of the financial issues facing them, women can make financial plans that take their unique challenges into account. Any good financial plan should be tailored to the individual, but it’s particularly important for women to seek out female-centric advice and resources to make sure they are prepared for the future, especially in an environment in which the default assumptions tend to be geared towards men’s needs. Women should consider the potential need for providing childcare and eldercare, longer lifespans, and higher medical costs when creating their plan, ensuring they are prepared for these potential impacts on their saving and spending.

Importantly, having a financial plan can also provide peace of mind. The 2012 Household Financial Planning Survey looked at the role of financial planning in helping families recover from the 2008/2009 financial crisis and found a significant impact. Many households reported that they were facing financial difficulties, but having a personal plan made people feel more prepared to meet their financial goals, more confident about their finances, and more likely to describe themselves as living comfortably across all income levels.13 Having a financial plan can help with tangible, day-to-day financial decisions, but can also reduce financial stress even in the aftermath of a major economic crisis.

For some women, creating a financial plan may mean hiring a planner or advisor to help in the process of sorting through financial goals. For others, it may be best to take advantage of the wealth of resources available online to create a plan themselves. Regardless of the method, having a written financial plan that addresses the challenges outlined in this paper can help women prepare for their financial future despite the many causes of the wealth gap.

While the wealth gap is unlikely to disappear soon, investing more and creating a thoughtful financial plan can help women close that gap on an individual level. If you would like to discuss ways to ensure that the wealth gap won’t limit you from reaching your financial goals, please contact Pekin Hardy Strauss Wealth Management.

[1] Women and Financial Wellness: The Bottom Line, Merrill

[2] The Gender Wage Gap: 2018 Earnings Differences by Race and Ethnicity, Institute for Women’s Policy Research

[3] The Child Care Crisis is Keeping Women Out of the Workforce, Center for American Progress

[4] Is the cost of childcare driving women out of the U.S. workforce?, Washington Center for Equitable Growth

[5] Unpaid Elder Care in the United States – 2017-2018 Summary, U.S. Bureau of Labor Statistics

[6] The Crisis Facing America’s Working Daughters, The Atlantic

[7] Life Expectancy Calculator, The Social Security Administration

[8] The High Cost of Living Longer: Women and Retirement Healthcare, HealthView Services

[9] There’s An Investing Gap That Costs Women Up to $1 Million. Here’s How to Fix It, Money.com

[10] Women Are Better Retirement Savers Than Men, But Still Have a Lot Less Money, Money.com

[11] Do women really make better investors than men?, Financial Times

[12] Women and Financial Wellness: The Bottom Line, Merrill

[13] 2012 Household Financial Planning Survey, CFP.net

This article is prepared by Pekin Hardy Strauss, Inc. (“Pekin Hardy”, dba Pekin Hardy Strauss Wealth Management) for informational purposes only and is not intended as an offer or solicitation for business. The information and data in this article does not constitute legal, tax, accounting, investment or other professional advice. The views expressed are those of the author(s) as of the date of publication of this article, and are subject to change at any time due to changes in market or economic conditions. Pekin Hardy cannot assure that the strategies discussed herein will outperform any other investment strategy in the future.