“An election is coming.

Universal peace is declared,

and the foxes have a sincere interest

in prolonging the lives of the poultry.”

─ George Eliot

These days, clients are often asking us, “What is going to happen to the stock market if Trump wins?”1 Others are asking, “What will happen to the stock market in the run-up to the Presidential election?”

A few weeks ago, we recorded a Managing Your Money video to discuss this topic, and this letter includes many of the points expressed in that discussion. To summarize, while we do not pretend to know who will win the election, we believe it is generally a poor idea to make short-term market timing calls. The long-term macroeconomic drivers are more important in influencing the direction of the capital markets; fiscal deficit-driven inflation will inevitably continue, regardless of who sits in the Oval Office in January, with much more important investment implications. In this note, we will touch on historical stock market performance during and after Presidential elections, the election’s sector-specific impact, global trade considerations, and client portfolio positioning in anticipation of any unique risks or opportunities related to the coming election.

Historical Context of Elections and Market Behavior

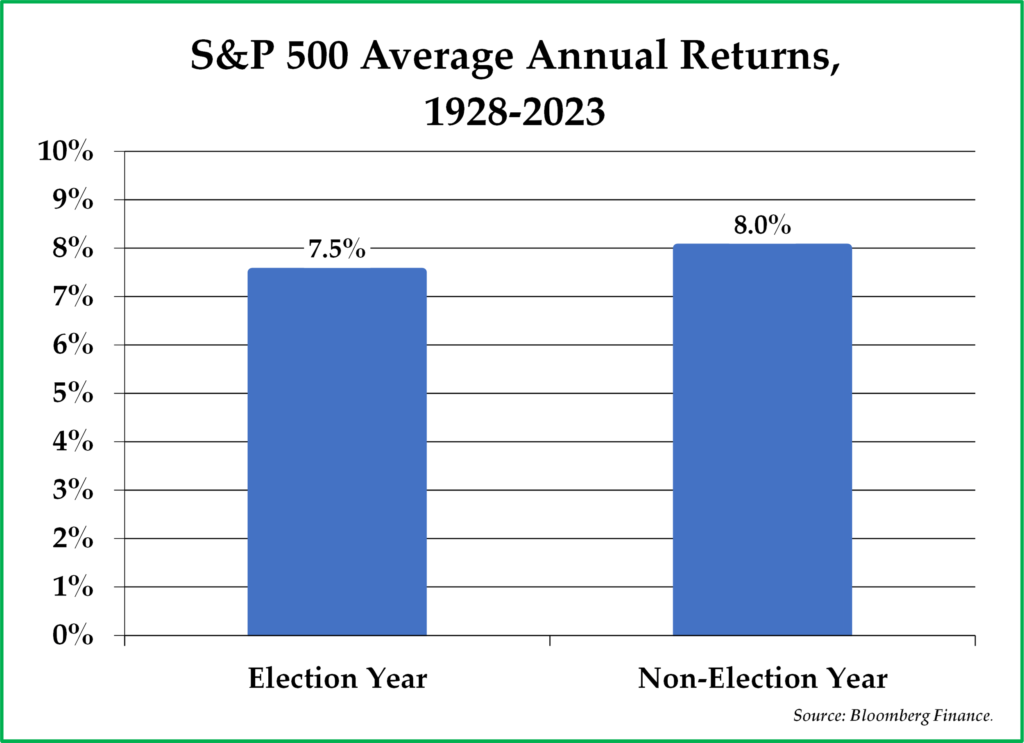

Let us begin by looking at election year stock markets from history, as historical trends provide valuable insights into how elections might or might not influence financial markets. Going back to 1928, the data on the next page suggest that election years tend to generate similar returns as non-election years, at least on a full-year basis, with non-election years outperforming election years by ~0.5% per annum on average.2

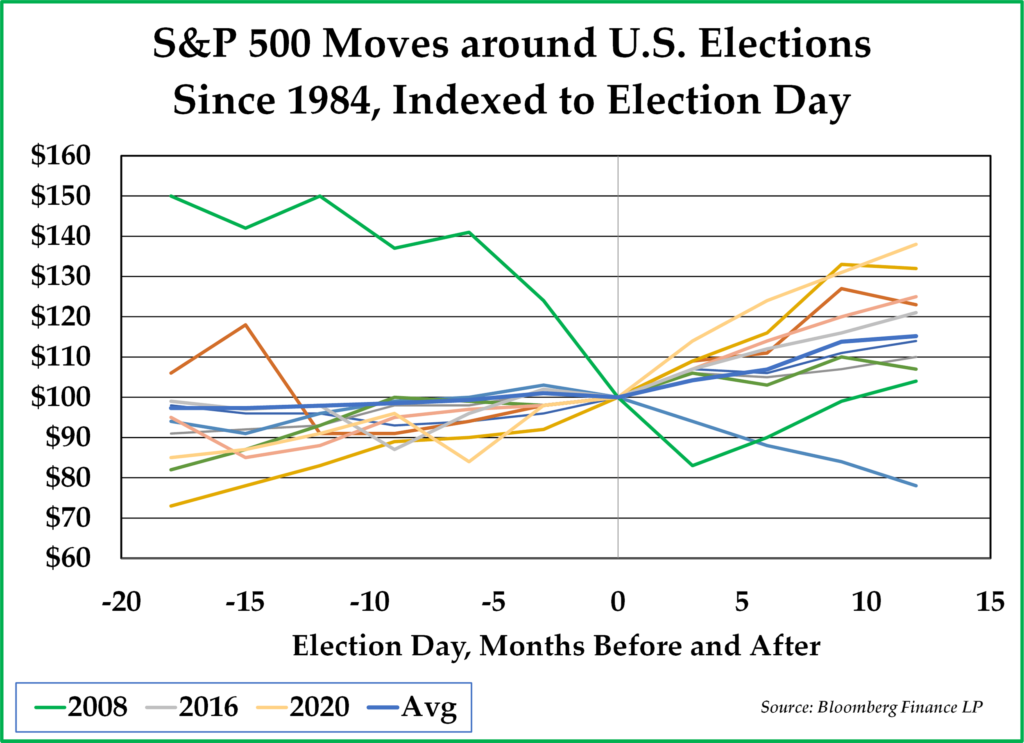

Looking at U.S. presidential elections since 1984 (below and to the right), the data suggest that the stock market tends to be flattish during the 12 months leading up to election day, whereas the stock market generates a ~10% return in the 12 months after election day. This data makes intuitive sense as the market gains confidence with certainty, and the market will have increased certainty once the next President is elected.

There were two critical historical anomalies in this time series. First, in 2008, an election year, the stock market crashed during the 12 months leading up to the election. Second, in 2020, the stock market crashed for a month, then recovered, and then went on to appreciate by 40% in the aftermath of the election. In both years, important historical events, a global financial crisis and a worldwide pandemic, far outweighed any potential election-related impact.

Nothing in this data compels us to consider making a market-timing decision in light of the fact that an election is approaching.

Economic Policies

Over the past quarter century, an increasingly narrow percentage of the U.S. public have disproportionally benefited from economic growth and gains in wealth. With both candidates understanding this fact, both candidates are adjusting their rhetoric and taking action to broaden their electoral appeal. President Biden is attempting to cancel billions of dollars of student loans to increase his popularity with students and former students with student debt loads. Meanwhile, former President Trump has become very friendly towards the cryptocurrency industry and offered to eliminate taxes for waiters and waitresses, courting these sorts of young voters.

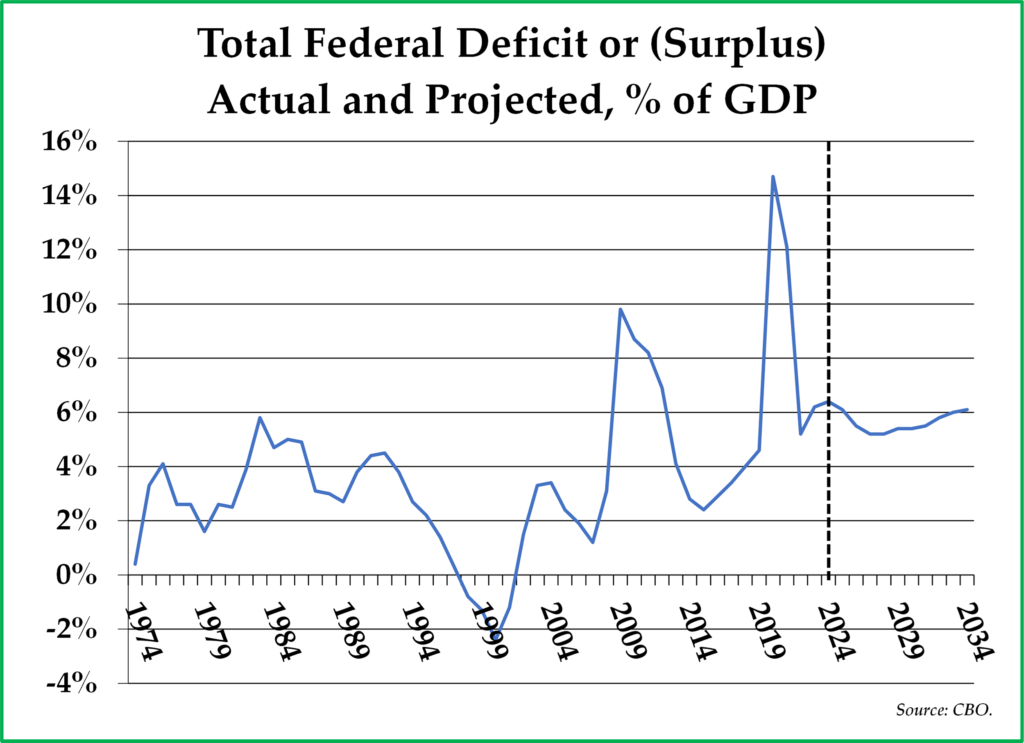

For similar reasons, the existing entitlement programs that already provide significant benefits to a broad percentage of the U.S. population continue to enjoy bipartisan support, with neither candidate suggesting any meaningful reforms. Both candidates want Social Security, Medicare, and Medicaid left largely intact, despite the fact that, according to the Congressional Budget Office, these programs are set to drive persistently larger fiscal deficits for years to come, even assuming no changes to current law.

With both candidates offering new and existing economic benefits to assist the shrinking middle class, both candidates aim to persuade voters to feel better about their candidacy when they go to the polls on election day. The reality is that both are proposing or enacting policy prescriptions that are incrementally inflationary at a time when inflation has already been running quite hot over the past three years. Assuming that the next President is able to cause an increase in middle-class wages, that President would be able to declare a significant political victory, but it may also result in a somewhat Pyrrhic victory — another inflationary wave driven by these same wage increases.

One significant policy difference between the two candidates relates to immigration. If Joe Biden wins the Presidency, we would assume that current migration trends will continue. In contrast, if Donald Trump wins the Presidency, mass migration would likely cease, and it’s possible that many migrants may be forced or incentivized to return to their home countries. This policy difference likely has investment implications. All things being equal, large numbers of migrants create additional demand for housing and create an additional supply of workers, exacerbating the cost of housing while dampening wages (and enhancing corporate profit margins).

We present these thoughts not as a criticism but as an unbiased analysis of the political environment. We conclude that today’s political environment is overall quite inflationary and will likely remain so during the next few years.

Favored and Unfavored Sectors

In Presidential election years since 1972, the Technology and Materials sectors typically have been the two worst performing sectors, by far, while the best performing sectors have differed from one election to the next depending on the proposed policies of the Presidential candidates.

While the question of who becomes our next President is undoubtedly important, a President’s impact on the economy is somewhat constrained by the balance of powers written into the U.S. Constitution. To pass any spending or tax bills, the President will need to secure the approval of Congress and the Senate. With a split government, either candidate will be constrained in terms of his ability to pass spending or tax bills. Should the President, the House, and the Senate all be won by the same political party, then whichever President wins will have more ability to enact legislation that supports his agenda. But, as highlighted earlier, both Presidents want to pursue economic policies that are inflationary.

One economic area where the President has more freedom to act without Congressional approval is trade policy. Under current law, the President is allowed to implement tariffs without needing Congressional approval if the imports pose a threat to national security, if the U.S. Trade Representative finds that foreign trade practices are unfair, or if there is a national emergency. These exceptions provide a President with quite a bit of room to maneuver.

When Donald Trump was President, he enacted tariffs across a wide range of imported goods from China and is promising to increase tariff rates further if elected President. Meanwhile, President Biden left former President Trump’s tariffs in place and enacted further tariffs, targeting electric vehicles, solar cells, steel, aluminum, and semiconductors imported from China.

Such tariffs raise some revenue for the U.S. government and raise prices on imports, making domestic manufacturers more competitive and foreign manufacturers less competitive. These policies are helpful for domestic producers and could lead to additional high paying manufacturing jobs, which is part of the point of import tariffs, while at the same time raising the price of imported goods, which is inflationary.

Given the campaign rhetoric, it appears that we will be seeing increasing tariffs, regardless of which candidate is elected President. The prospect of increasing tariffs causes us to be more constructive regarding U.S. manufacturing growth and less constructive with regard to U.S. consumer spending, all things being equal, regardless of who wins the election.

The Election and the Bond Market

In the early 1990s, political strategist James Carville famously said, ”I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.” While the U.S. bond market has been somewhat complacent over the last two decades, we wonder how long this complacency can continue in the face of elevated inflation, increasing deficits, and unsustainably high levels of government debt. Furthermore, we wonder, is a financial crisis akin to the 1997 Asian Financial Crisis headed for the United States, and do the chances of such a crisis happening differ depending on who becomes President?3

Because of former President Trump’s inclination to lean on the Federal Reserve to keep interest rates low, it seems to us somewhat more likely to us that, if a bond and currency tsunami is headed for U.S. shores, it could arrive sooner and with more force under a President Trump than under a President Biden. Having said that, we would not want to expose our clients to long-term Treasury bonds regardless of who takes the Oval Office. The risk of a bond and currency crisis looming over the intermediate period ahead is far higher than we would like regardless of the election outcome.

When considering a potential crisis in bonds and currency, we are also reminded of what former Chicago Mayor Rahm Emanuel famously said when he was President Obama’s chief of staff: ”Never let a crisis go to waste.” If we were to assume a crisis were to take place during the 2025-2029 period, a President Trump and a President Biden would likely respond to the crisis very differently from one another. In a crisis, everything is on the table, including structural reform, including entitlement reform, including tax policy, and including any reform which might be too unpopular to consider in a more complacent, non-crisis environment. All things being equal, we would think that, in response to a crisis, President Biden would be more inclined to impose draconian tax rates, while President Trump would be more inclined to impose deep cuts to government spending programs.

Investment Implications

The bottom line is that this election probably has less of a direct impact on markets and big-picture economic trends than voters and investors might believe that it will. With regard to the economy and the broader capital markets, we believe the election should matter only on the margin. For that reason, from an investing standpoint, we also think the election should matter only on the margin.

Our clients own gold and hard assets because our outlook is inflationary, regardless of whether Donald Trump or Joe Biden becomes the next President. For the same reason, our position in long-term bonds is de minimis. And, as always, we are looking for temporarily mispriced, undervalued securities to buy, with a plan to own those investments until the market recognizes the value that we see. That strategy should yield satisfactory returns regardless of the environment and regardless of any election outcome.

Sometimes the right investment strategy is to sit on your hands and continue to be patient and not let your emotions become unduly influenced by the political news flow. We believe today is one of those times.

*****

We work hard every day knowing that you have entrusted us to manage your assets and endeavor to be careful in the way that we manage them. Thank you again for providing us with your trust.

Sincerely,

Pekin Hardy Strauss Wealth Management

1As an aside, we have also been asking ourselves, why write a letter about the presidential election when circumstances surrounding the election are changing so quickly? Despite our trepidation of broaching such a topic, we proceed nonetheless.

While writing this letter, we are aware that it is possible that President Joe Biden may resign his office and/or give up on his Presidential candidacy, given his lackluster performance in the recent debate with Donald Trump. We do not pretend to know the future, but we think it’s safe to assume that public policy will not change substantially if another Democratic candidate besides Joe Biden were to become President in January 2025. When we say “Joe Biden” in this letter, you can assume that represents Joe Biden or any potential mainstream Democrat stand-in replacement for Joe Biden.

We are also writing this letter aware of the recent assassination attempt that occurred on July 14, 2024. Fortunately for former President Trump and the country, the bullet missed and the attempt failed. We would expect that an assassination of either candidate would cause significant volatility in the stock and bond markets and would be quite bullish for gold prices.

2We are using the S&P 500 Index as a proxy to generalize equity returns with this data.

3In the 1997 Asian Financial Crisis, countries across East Asia suffered falling currency levels, spiking interest rates, and a precipitous rise in private debt. Three primary factors caused this crisis: financial sector weakness driven by easy liquidity conditions, large current account deficits, and regional contagion.

This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy, focusing on the large-cap segment of the market.